IAIC Market Update - May 9, 2022

Last Week in the Markets: May 2nd – 6th, 2022

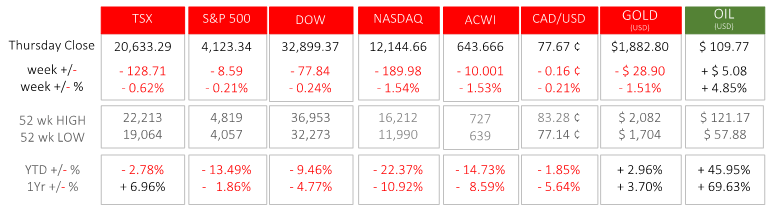

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- At 2 pm Eastern on Wednesday the U.S. Federal Reserve increased short term interest rates. The 50-basis point increase (+0.50%) to the federal funds rate was the largest increase since 2000. (Source)

- Immediately after the Fed’s announcement, equity markets reacted positively, but the gains achieved on Wednesday were reversed on Thursday. The Dow rose 932 points before losing 1,063, the S&P 500 gained 125 points, then lost 154. The TSX gained a total of 473 points on Tuesday and Wednesday before dropping 489 on Thursday. The NASDAQ gained 402 points on Wednesday before dropping 764 by week’s end.

- The VIX Volatility Index rose during the second half of last week and now sits near its highest level since March 2020 when the pandemic was in its early, most unpredictable stages. Until inflation is tempered, supply chain issues resolved, and energy costs are more stable, volatility will likely remain above average.

- The Federal Reserve’s increasing of interest rates was further justified on Friday when April’s non-farm payrolls showed that employment had increased by 428,000. With the unemployment rate (3.6%) and number of employed (5.9 million) holding steady, the Bureau of Labor Statistics indicated the similarity of these numbers to pre-pandemic data in February 2020. The labor force participation rate is 1.2 percentage points below the February 2020 level of 63.4%. (Source)

- In Canada, the employment numbers also released on Friday provided a mixture of positive and negative news. The number of jobs remained unchanged in April, as did the employment rate (61.9%) and the unemployment rate edged downward by 0.1% to 5.2%. Average hourly wages rose at an annualized rate of 3.3%, also unchanged from March. (Source)

What’s ahead for this week?

- In Canada, March’s building permits are part of a light week for economic announcements amid the quarterly earnings season. Several large entities like Boardwalk and RioCan REIT, George Weston, Suncor, Manulife, Quebecor, and Canadian Tire will report their most recent performance.

- In the U.S., inflation will dominate the economic releases. The Consumer Price Index (CPI) for April will be announced on Wednesday, followed by the Producer Price Index (PPI) on Thursday. Import and Export Price Indexes will be released on Friday.

- Globally, scheduled announcements include China’s Consumer and Producer Price Indexes, trade surplus and money supply, Japan’s Purchasing Managers Indexes, household spending and bank lending, Germany’s CPI, and the Eurozone’s industrial production.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.