IAIC Market Update - May 2, 2022

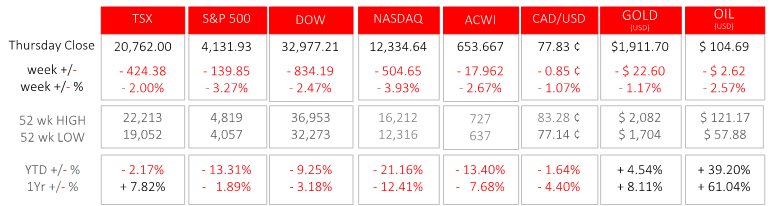

Last Week in the Markets: April 25th – 29th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- For the fourth consecutive week, all equity indices in our reporting table lost value; decline has ranged between 5% – 13%. The TSX, which has been supported by rising commodity prices and lost 5% in April, has delivered a relatively strong performance among equity indices. The reasons for the negative performance include:

- Domestic, international, and global inflation remains high, and well beyond the goals set by central banks.

- As inflation rises, central banks have begun to act. The Federal Reserve is likely to raise interest rates ½ point next week. The Fed along with other central banks want to slow growth by raising the cost of borrowing for individuals, families and firms. Increasing the cost of financed goods and services will temper economic growth, which may eventually cause inflation to slow.

- Although the spread of the coronavirus has slowed and its effects have been less severe based on hospitalization and death rates, the pandemic continues in China. Lockdowns are again affecting growth for the world’s second largest economy.

- Contradictory Gross Domestic Product (GDP) numbers in the U.S. require additional scrutiny to be understood. The U.S. economy shrank at an annualized rate of 1.4% in the first quarter of 2022, after growing at a rate close to 7% at the end of last year. The results were somewhat of a surprise with analysts predicting a growth of 1%. (Source1, Source2)

- The protracted invasion of Ukraine continues to threaten global supply chains and economy.

- Earnings season has delivered less than stellar results.

What’s ahead for this week?

- In Canada, the merchandise trade balance will be released along with April’s employment numbers.

- In the U.S., March’s construction spending, factory orders, trade deficit and consumer credit will be announced. Purchasing Managers Indexes (PMI) from Markit and ISM will be released for goods and services. On Wednesday at 2 pm Eastern the Federal Open Market Committee of the Federal Reserve will release its latest monetary policy for short-term interest rates and bond-buying. Non-farm payrolls will be announced on Friday.

- Globally, PMIs for China, Japan and Eurozone will be released. Germany’s joblessness, trade surplus, retail sales and factory orders will be announced. OPEC+ will hold a production and pricing meeting.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.