IAIC Market Update - May 16, 2022

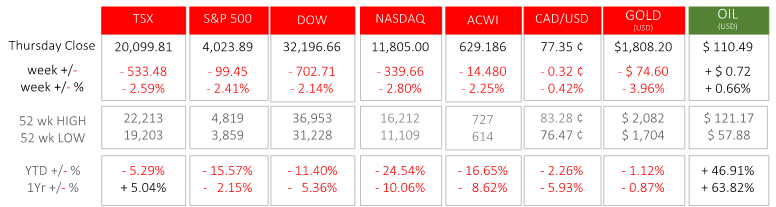

Last Week in the Markets: May 9th – 13th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was not a positive week with full-week losses exceeding 2%; however, Friday saw North American equity indices rising between 1½% and nearly 4%,

- The release of the U.S. Consumer Price Index (CPI) on Wednesday morning was a significant contributor to equity volatility and losses last week. Thankfully, price increases during April were less than March, but the annual and monthly inflation rate remains at a historically high level. Inflation of 8.3% over the past year was led by shelter, food, airline fares and new vehicles. Ongoing inflation at this high rate indicates that the Federal Reserve may remain aggressive on monetary policy, especially for short-term interest rates. With the monthly rate dropping to 0.3% in March from 1.2% in April, it appears that inflation may have peaked, which is a small measure of positive news. (Source)

- The Producer Price Index (PPI), which is the measure of inflation at the wholesale level, is beginning to slow. In April the PPI fell to 0.5% after February’s 1.1% and March’s 1.6% rise in prices. Interestingly the price increase for goods was 1.3% as services prices remained unchanged. (Source)

- China’s CPI and PPI in April arrived above estimates at annualized rates of 2.1% and 8%, respectively. These prices were driven by increasing demand due to panic buying as another pandemic wave hit, continuing supply chain issues, and rising commodity prices driven by the invasion of Ukraine. (Source)

- The supply chain and commodity price issues affecting China are global, and until they are resolved inflation will persist in North America and globally. Central banks will seek to temper inflation by increasing interest rates. The Federal Reserve has telegraphed ½% increases at its next two monetary policy meetings on June 15th and July 27th. While interest rates rise and the fear of

stagflation or

recession loom, capital markets will continue to deliver volatile results. (Source1,

Source2)

What’s ahead for this week?

- In Canada, March’s manufacturing sales and new orders, construction investment, and April’s housing starts, existing home sales, MLS Home Price Index and new housing price index will be announced. CPI will also be released and will be next week’s most influential indicator for Canadian investors.

- In the U.S., April’s retail sales, industrial production, business inventories, housing starts, building permits and existing home sales are scheduled for release as earnings season winds down.

- Globally, China’s retail sales and industrial production, Japan’s machine tool orders, CPI, and Gross Domestic Product (GDP), Eurozone’s trade deficit, GDP, CPI and PPI will be released.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.