IAIC Market Update - May 3, 2021

Last Week in the Markets: April 26th - 30th, 2021

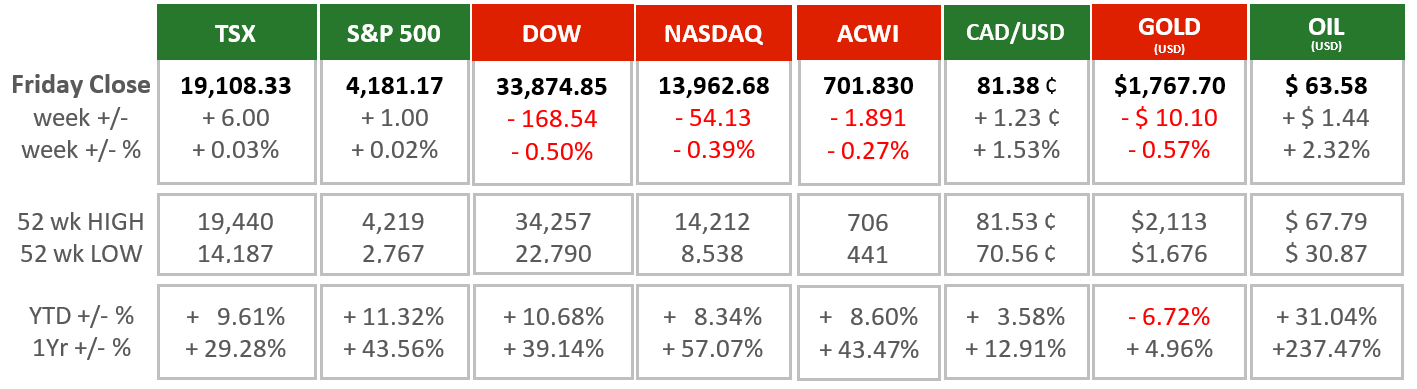

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

The NASDAQ, S&P 500, and Canada’s S&P/TSX indices reached all-time record highs for the first part of the week before falling back on Friday. (Source)

- Solid corporate earnings have been turned in for the latest quarter.

- President Biden continued to advance his economic recovery plan with several trillion dollars of spending. The bills introduced include the $1.8 Trillion American Families Plan (education, child-care and social supports), the $2.3 Trillion American Jobs (infrastructure) and the approved $1.9 Trillion American Rescue Plan (pandemic relief and stimulus).

- U.S. and Canadian economic expansion/recovery is occurring more quickly than first anticipated.

- Canadian retail sales are rebounding more quickly than expected. As an example, Shopify which is a major component of the TSX, reported sales much higher (about double) and profits (almost triple) ahead of expectations.

- The Federal Reserve continues to support economic recovery despite a rise in the rate of inflation which could eventually cause interest rate increases. The Bank of Canada made a similarly toned announcement nearly two weeks ago.

- Pandemic case numbers are again rising in many parts of the world with the threat of renewed lockdowns and restrictions loom. India has had more than 400,000 cases daily while they experience shortages of critical supplies like oxygen.

What’s ahead for this week?

- In Canada, March’s merchandise trade balance is the sole major expected economic announcement.

- In the U.S., Purchasing Managers Indices from Markit and PMI for April, March’s construction spending, goods and services trade index and factory orders data are all scheduled for release.

- Globally, Eurozone manufacturing PMI is on the calendar, as well as German retail sales, industrial production and factory orders. Chinese markets will be closed at the beginning of the week before they announce their April trade surplus. Also, the Bank of England monetary policy announcement and report on Wednesday.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.