IAIC Market Update - April 26, 2021

Last Week in the Markets: April 19th - 23th, 2021

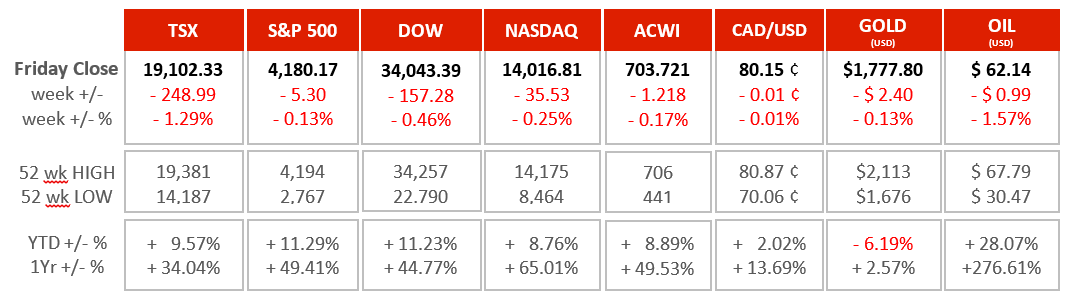

545(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

North American and global equities, the Canadian dollar, gold and oil all lost value last week. Results can be directly related to faltering success against the COVID-19 pandemic and increased fears of ongoing and increasing economic damage.

- The federal government released its first budget in two years that included $101.4 Billion in new spending to provide pandemic relief and position Canadians and businesses for future economic success. The budget deficit is projected at $354 Billion for the year ended March 31, 2021 and $155 Billion for the current fiscal year.

- The Bank of Canada (BoC) held its benchmark interest rate unchanged in its continued support for economic recovery. It has forecast Canadian Gross Domestic Product (GDP) growth for the first quarter at 7%. Based largely on this high rate of growth, the BoC is planning to reduce its bond purchase program and has indicated that interest rates may increase sooner than earlier projections.

- In the US, the White House announced a proposal to increase taxes on capital gains that increased downward pressure on equities. It was counter-balanced by first quarter earnings reports that generally exceeded analysts’ expectations.

- The European Central Bank (ECB) kept its interest rates steady and indicated that bond purchases would be increased to support the collective Eurozone economy.

What’s ahead for this week?

- In Canada, February’s retail sales, employment reports and Gross Domestic Product (GDP) are scheduled for release, as are March’s industrial and materials price indices.

- In the U.S., durable goods orders and goods trade deficit, pending home sales and personal spending and income for March will be announced. On Wednesday, the Federal Reserve will release their latest monetary announcement and conduct a news conference featuring Chair, Jerome Powell. Later, on Wednesday evening, President Biden will deliver his first address to Joint Session of Congress (Senate and House members).

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.