IAIC Market Update - May 24, 2022

Last Week in the Markets: May 16th – 20th, 2022

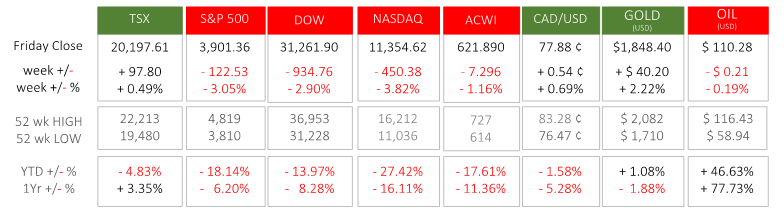

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a difficult week for equities; the TSX gained ½ point while the American indices lost 3-4%. The S&P 500 achieved its seventh consecutive weekly loss and is approaching a 20% drop of a Bear Market. The Dow has had eight weeks since it last gained on a week-to-week basis. All the indexes have lost ground in 2022,

- The economic news that predicated the U.S. stock losses last week was mixed. Walmart and Target disappointed on the earnings front but indicated that foot traffic and spending remains positive as consumers moved away from pandemic necessities. Demand is strong while supply-chain issues remain. Further, consumer spending that comprises about two-thirds of U.S. Gross Domestic Product (GDP) is healthy, a tight labour market with rising wages and low unemployment, and moderating, yet historically strong, corporate earnings.

- Canada’s Consumer Price Index (CPI) rose in April slightly to 6.8% compared to March’s 6.7%. Food and shelter were two categories that drove the increase. “With the unemployment rate falling to a record low in April, strong employment figures tend to put upward pressure on prices. In April, average hourly wages for employees rose 3.3% on a year-over-year basis, meaning that, on average, prices rose faster than wages, and Canadians experienced a decline in purchasing power.” (Source)

- Both the Bank of Canada and the Federal Reserve have mandates to fight inflation, and both have indicated their intention to combat rapidly rising prices with higher interest rates. (Source1,

Source2)

What’s ahead for this week?

- Markets were closed in Canada Monday May 23rd, 2022 to observe Victoria Day four-day week will include announcements of April’s manufacturing sales, wholesale trade, and March’s retail sales and employment survey. Also, the major Canadian banks will release their latest quarterly earnings.

- In the U.S., April’s new home sales, pending home sales, durable goods orders and core orders, personal income and spending and goods trade deficit will be announced. The minutes from the Federal Reserve’s FOMC meeting that raised interest rates ½ point will be released.

- Globally, Germany’s business climate, Gross Domestic Product and consumer confidence will be released along with the Eurozone’s Purchasing Managers Indices in a light week for economic announcements.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.