IAIC Market Update - March 7, 2023

Last Week in the Markets: : February 27th – March 3rd, 2023

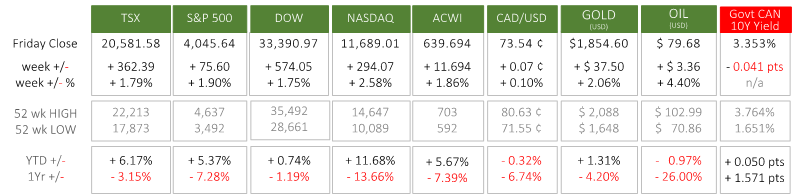

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The North American equity indexes rose 1¾ to 2½ percent, the Canadian dollar strengthened marginally, and both gold and oil rose.

- After peaking last summer headline inflation, the Consumer Price Index (CPI), had begun to fall slightly, but then its decline stalled.

- Consumer prices in Spain, France and Germany, Europe’s largest economy, rose in February. U.S. prices rose 0.5% in January compared to December.

- Canadian year-over-year inflation dropped slightly, but only because January 2023 price increases paled in comparison to those in January 2022.

- Interest rate announcements are scheduled to be released in the next 3 weeks - Bank of Canada (March 8th), European Central Bank (March 16th) and the Federal Reserve (March 22nd). Both the European Central Bank and Federal Reserve have indicated that additional interest rate increases are necessary. The Bank of Canada is hinting at a more cautious approach.

- Until the upcoming rate announcements occur and the economic indicators on which they are based, like inflation, employment, and wages are known, increased levels of volatility for equities may be the short-term result.

Sources:

U.S. inflation,

BNN and Fed,

Canada inflation,

Eurozone inflation

What’s ahead for this week?

- In Canada, the most important announcements will be the Bank of Canada’s interest rate decision on Wednesday, and the latest employment data on Friday.

- In the U.S., durable goods and factory orders, wholesale trade, mortgage market and mortgage refinance indexes, imports, exports and trade balance, average hourly earnings and the non-farm payroll report will be released. Also, Fed Chair, Jerome Powell, will testify on the U.S. central bank's semi-annual monetary policy report to the House Financial Services Committee.

- Globally, the import, export and trade balance reports continue with China. The Bank of Japan will announce its latest monetary policy and interest rate decision after consumer and producer inflation is released. Eurozone retail sales and Gross Domestic Product are scheduled, and several European Central Bank leaders, including President Lagarde, President of the European Central Bank, will deliver speeches during the week.

Source:

Fed Chair to Testify

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.