IAIC Market Update - March 14, 2023

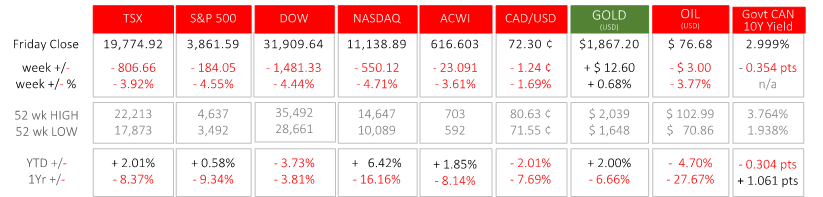

Last Week in the Markets: March 6th to March 10th, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Concern for the continued rise of inflation and additional interest rate increases in the U.S. weighed on markets last week. Domestically, the Bank of Canada held its target for the overnight rate steady at 4½% on Wednesday. This is the first time that interest rates have been held steady since January 2022, following eight consecutive rate increases.

- The slowing of the Canadian jobs market, a top indicator of economic growth, enabled the Bank of Canada’s position to pause rate increases. The Canadian economy added 22,000 jobs in February, an increase of 0.1% for the month. Total employment has risen to 20,054,000, and the unemployment rate was unchanged at 5.0%. Wages have risen 5.4% on a year-over-year basis in February, which is an increase from January’s annualized wage gain of 4.5%.

- Unfortunately, the impact of the Bank of Canada’s decision was overwhelmed by the Federal Reserve. Fed Chair, Jerome Powell, testified to Congress last week, and said, “if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes” and “the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated”. A strong or strengthening economy means that previous interest rate increases have not yet caused the desired effect of slowing demand in the economy, which will in-turn, slow inflation. The sentiment that more interest rate increases will cause a deeper recession grew last week.

Sources:

StatsCan Feb jobs,

BoC interest rate decision,

CNBC and Powell Testimony,

Powell Opening Statement,

Watch Powell Testimony

What’s ahead for this week?

- In Canada, January sales data for manufacturing, wholesale, and new vehicles will be reported. Industrial and raw materials price indexes will be released, which will foreshadow future consumer inflation numbers.

- In the U.S., the Consumer Price Index (CPI) for February will be released on Tuesday prior to the opening of markets. The next day, the Producer Price Index (PPI) will be announced. Volatility is expected to increase both before and after the release of these two important indicators. Other important releases scheduled include building permits, housing starts, import and export price indexes, industrial production, retail sales, and business inventories.

- Globally, the European Central Bank (ECB) will announce an interest rate decision on Thursday and conduct a press conference. On the following day, Friday, consumer inflation for the Eurozone will be released. China, the world’s second largest economy, will report its retail sales and industrial production.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.