IAIC Market Update - March 14, 2022

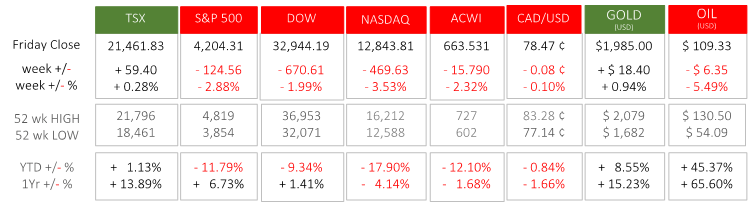

Last Week in the Markets: March 7th – 11th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The U.S. and U.K. both introduced a ban on the importation of Russian oil with the U.S. also banning Russian natural gas. Immediately after President Biden’s announcement regarding Russian oil, the price of West Texas Intermediate (WTI) crude jumped 8% before settling back down. Despite the price spike and volatility, the price of oil fell compared to last week’s close. (Source)

- On Thursday, the latest U.S. inflation numbers were released. The Consumer Price Index (CPI) rose 0.8% in February and 7.9% over the past 12 months (before seasonal adjustment). The two most significant contributors to the highest rate of American inflation in the past 40 years were Food (7.9%), and Energy (25.6%). Excluding Food and Energy, the All-Items index, prices rose 6.4%, which is the largest 12 month change for this category of goods and services since August 1982. (Source)

- The European Central Bank met in Frankfurt and announced their latest policy to address Continental consumer inflation and, secondarily the crisis in Ukraine. Bond buying will end this summer, which will then allow for interest rate increases to trim inflation. The war in Ukraine is expected to contribute to additional inflation and lower economic growth. (Source)

- On Friday Canadian employment data was released. During the month of February 337,000 jobs were created and at month’s end the unemployment rate dropped 1.0% to 5.5%. The unemployment rate is lower than February 2020 and the total number of jobs exceeds the level of two years ago. (Source)

What’s ahead for this week?

- In Canada, January’s retail sales, construction investment, manufacturing sales and new orders, wholesale trade and new vehicle sales, February’s housing-starts and existing home sales will be announced. The Consumer Price Index for February will also be released.

- In the U.S., the Producer Price Index, retail sales, import prices, housing-starts, existing home sales, industrial production and capacity utilization are scheduled. On Wednesday at 2 pm Eastern the Federal Reserve Chair, Jerome Powell, will announce the latest monetary policy.

- Globally, Chinese industrial production, retail sales and fixed asset investment, Eurozone trade deficit, labour costs, industrial production and CPI will be released. Sanctions against Russia that are designed to punish Russians and pressure Putin to withdraw from Ukraine will require time to be effective.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.