IAIC Market Update - March 21, 2022

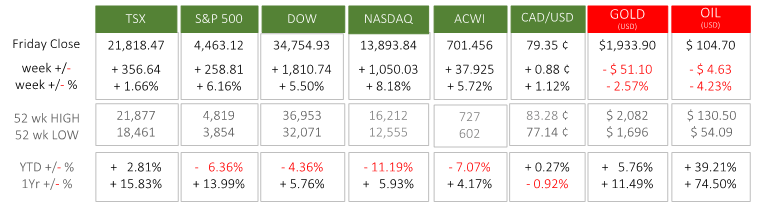

Last Week in the Markets: : March 14th – 18th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Equities performed exceptionally well as the TSX set a new all-time high and U.S. indices made major gains. The S&P 500, Dow, and NASDAQ have Year-to-Date negative performance as many unwound their positions in 2022. Institutional investors drove last week’s gains as the unwinding slows allowing fewer sellers to be outnumbered by buyers. Also, the interest rate increase was anticipated and had been priced-in prior to the announcement. (Source)

- Canada’s Consumer Price Index (CPI) rose an additional 0.6% in February and the annualized rate of inflation is 5.7%, the highest it has been since August 1991 when it was 6.0%. Food, housing, and gasoline were major contributors. Gasoline, for example, has risen 32% since February 2021, which is prior to the effects of the invasion of Ukraine. Thankfully, the rate is well below the 7.9% U.S. inflation rate, but still well above the range that the Bank of Canada has set as its target. (Source)

- In response to U.S. inflation sitting just under 8%, the Federal Reserve increased interest rates on Wednesday afternoon. The federal funds rate increased by ¼% to a range of ¼% to ½%. This was the first increase since 2018. The Fed’s mandate is to maximize employment and manage long-term inflation at 2%. Based on the current rate of domestic inflation and international pressures the Fed “anticipates that ongoing increases in the target range will be appropriate.” As many as six interest rate increases are expected from the Fed in the coming months. (Source)

What’s ahead for this week?

- In Canada, February’s industrial products and raw materials inflation and manufacturing sales will be released. The federal government’s budget balance for January is scheduled. Provinces are reducing or ending pandemic restrictions, creating confusion for communities, students, and workers.

- In the U.S., Purchasing Managers Indexes from Market and ISM representing optimism for corporate expansion, new home sales, pending home sales, and durable goods orders will be released.

- Globally, Eurozone consumer confidence, Japan’s machine tool orders, PMI and department store sales, European Central Bank’s economic bulletin are scheduled for announcement.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.