IAIC Market Update - March 7, 2022

Last Week in the Markets: February 28th – March 4th, 2022

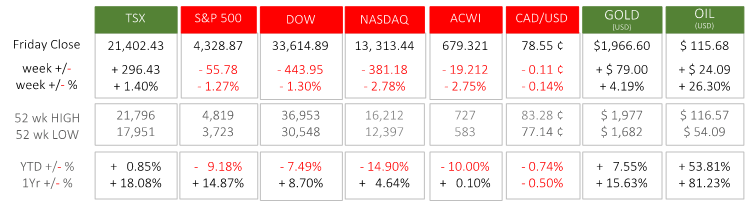

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- On Wednesday morning, the Bank of Canada (BoC) raised interest rates by ¼%. The overnight rate is now ½%, the Bank Rate is ¾% and the deposit rate is ½%. Rates had not increased since 2018. The BoC stated, “The unprovoked invasion of Ukraine by Russia is a major new source of uncertainty. Prices for oil and other commodities have risen sharply. This will add to inflation around the world. . .” (Source)

- The U.S. Federal Reserve will make a monetary policy announcement on March 16th. The BoC’s move, based on inflation, employment, and international political events, could be foreshadowing to a potential increase by the Fed.

- On Friday, the Bureau of Labour Statistics released the latest non-farm payroll data. In February employment rose by 678,000 and unemployment fell slightly to 3.8%. As of the end of last month 6.3 million people remained unemployed compared with 5.7 million unemployed persons and an unemployment rate of 3.5% two years prior in February 2020. One of the major contributing factors to the shortfall in current employment is the Labor Force Participation Rate. In the U.S about 2 million less people are seeking jobs today than two years ago. In Canada, more people are employed today than 2 years ago. (Source)

- The invasion continues across Ukraine and will continue for the foreseeable future. The economic effects have already been felt. Commodity prices have surged dramatically adding more inflationary pressure to existing price increases caused by supply chain disruptions and emergence from the Covid-19 pandemic. “Price shocks will have an impact worldwide . . .” (Source)

What’s ahead for this week?

- In Canada, merchandise trade balance, goods and services trade deficit will be announced. The February employment report will be released on Friday.

- In the U.S., wholesale and retail inventories and budget balance for February will be released. The latest consumer inflation numbers will be released on Thursday in a precursor to the Federal Reserve’s announcement one week later.

- Globally, in addition to news from Ukraine or Russia, it will be a robust week for international economic releases. They will include Germany’s factory orders, retail sales, industrial production. China’s foreign reserves, trade surplus, and Consumer Price and Producer Price indexes; Eurozone’s GDP. Additionally, the European Central Bank will conduct and monetary policy meeting.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.