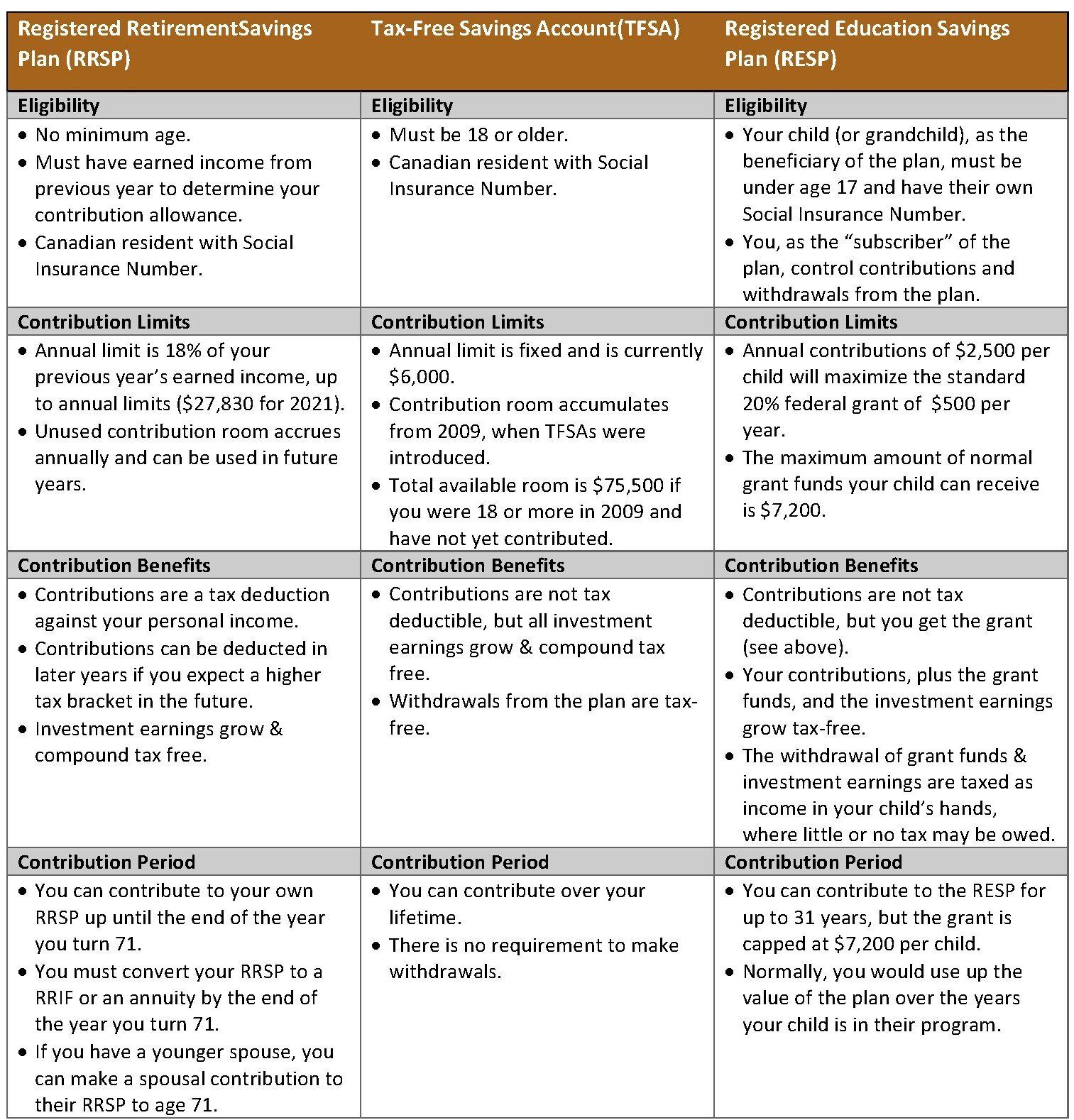

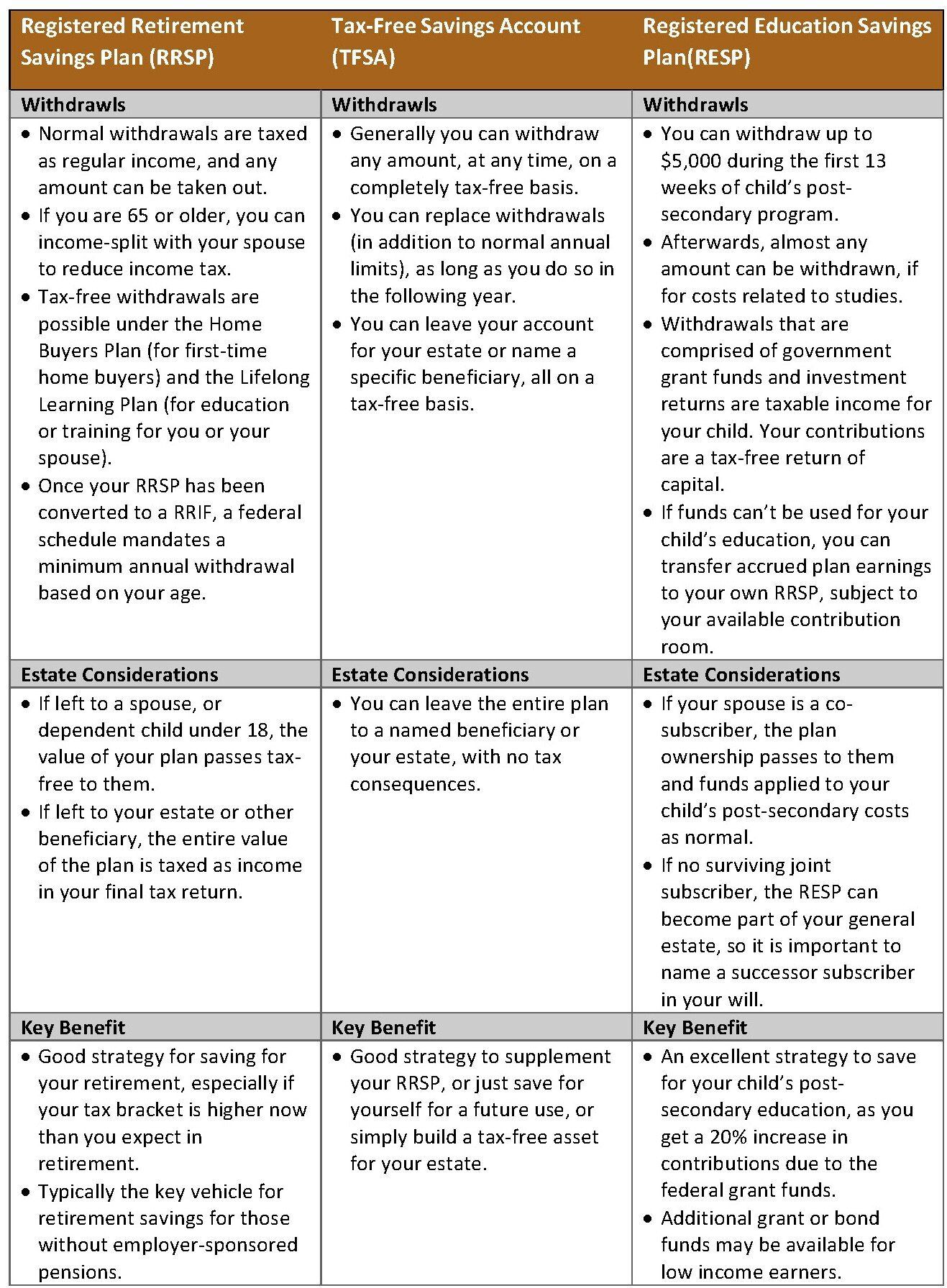

Comparing RRSP vs TFSA vs RESP

Do you know which mix of savings vehicles is right for you?

There are registered retirement savings plans (RRSPs), Tax-Free Savings Accounts (TFSAs), and registered education savings plans (RESPs). Determining which savings plan or combination of savings plans is best depends on your personal situation and your objectives.

Each savings vehicle can hold different types of investmens. Do you have an understanding of what your advisor may allocate your money to and the associated risks and benefits that accompany each? For a brief illustration of the main investment products, read Getting Started with Investing.

It is important to obtain professional advice, to continue the conversation with your wealth advisor and portfolio manager to gain further understanding of what is right for your unique needs.