Types of Life Insurance

Which option is best for you?

Term Life Insurance

A term life insurance policy provides the policyholder with insurance for a pre-defined period, typically one, five, ten, 15, 20 or 30 years, or until a specific age like 60 or 65.

If the term expires and you are still alive, there is no payout. However, you can decide whether to find a new policy or renew the coverage if that option is available. Term life insurance policies are usually renewable at a higher premium when they expire.

Since term life insurance policies have lower premiums than permanent ones, they are the most commonly purchased type of life insurance.

Permanent Life Insurance

Permanent life insurance has no term limit. It will last for your entire lifetime, provided all premiums are paid. The premiums are fixed and are significantly higher than term life insurance. Some permanent insurance plans also have cash value. If you cancel the contract, you can receive the cash value or use it as collateral for a loan.

There are two types of permanent life insurance;

Universal Life

and

Whole Life.

Universal life insurance is a combination of term insurance, permanent insurance and a savings/ investment account. You get the advantages of the affordability of a term plan, the potential lifetime protection of permanent insurance and the potential of tax-preferred savings growth within the life insurance policy.

Whole life insurance provides a combination of permanent life insurance protection and an opportunity for tax-preferred cash value and an increasing death benefit over time. The base insurance protection is guaranteed for life, as long as premiums continue to be paid. With whole life insurance, your policy may receive dividends as determined by the insurance company. You can use dividends to buy more insurance coverage, receive a cash payment, apply them to your annual premium or leave them on deposit – the choice is yours. With whole life insurance, depending on the dividend option you choose cash values build up over time on a tax-preferred basis which you can access whenever you need.

How Much Does Life Insurance Cost?

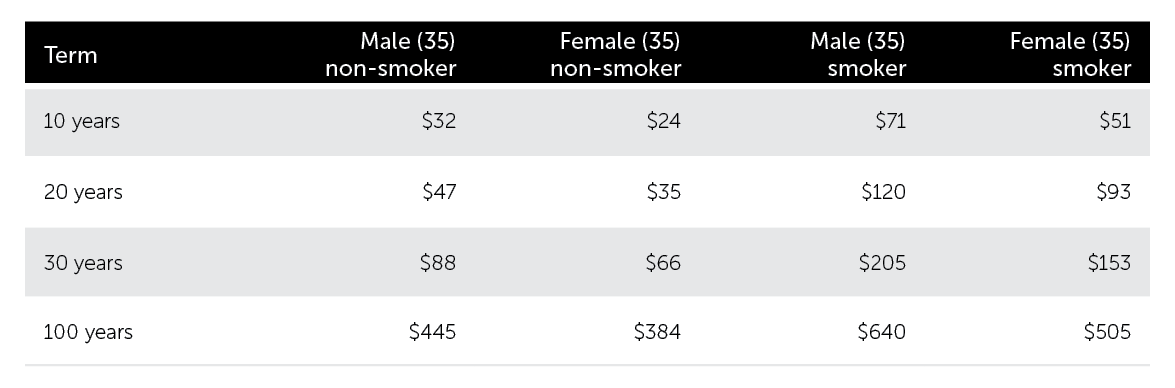

The cost of life insurance depends on multiple factors. Let’s look at a 35 year old looking to replace your income for your family for 10 years if you die. After completing a financial plan, it was determined you need

$750,000 of coverage.

For $750,000 in coverage, here is an example of what it could cost each month with a term life insurance policy. You’ll notice the rates are more than double for smokers:

Consult your accountant, financial planner, or insurance specialist to compare the different types of life insurance and to determine which type of life insurance is right for you.