IAIC Market Update - September 27, 2021

Last Week in the Markets: September 20th - 24th, 2021

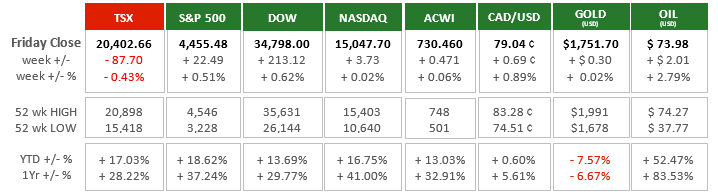

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Major domestic and international events influenced markets last week including:

- The U.S. Federal Reserve kept its monetary policy for interest rates and bond-buying unchanged in its announcement on Wednesday indicating, “If progress continues broadly as expected the Committee judges that a moderation in the pace of asset purchases may soon be warranted.” (Source)

- Concerns that China’s housing and property developer, Evergrande, could default on interest payments contributed to a decline in equity indices. Evergrande’s $300 Billion debt load and $100 Billion of real estate sales last year represent a significant concentration risk but should not threaten the stability of the global banking system.

- The Liberals were re-elected to another minority government in Monday’s Canadian federal election gaining an additional two years, potentially, to their mandate. A significant mandate in their election platform is to increase taxes on Canadian major banks, which nearly every Canadian investor owns directly or indirectly. (Source)

What’s ahead for this week?

- In Canada, employment numbers (new jobs, labour force participation, unemployment rate) for July will be announced. Real Gross Domestic Product (GDP) for July, an important indicator, will be released along with the industrial product price index and raw materials price index for August.

- In the U.S., durable goods orders, goods trade deficit, wholesale, and retail inventories, pending home sales, home price index, personal spending and income, construction spending, automobile sales and Purchasing Managers Indices, all for August, are scheduled for release in a busy week.

- Globally, Eurozone money supply, consumer and economic confidence, inflation and jobless rate will be released along with Japan’s jobless rate retail sales and industrial production and Germany’s consumer inflation and unemployment.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.