IAIC Market Update - September 20, 2021

Last Week in the Markets: September 13th - 17th, 2021

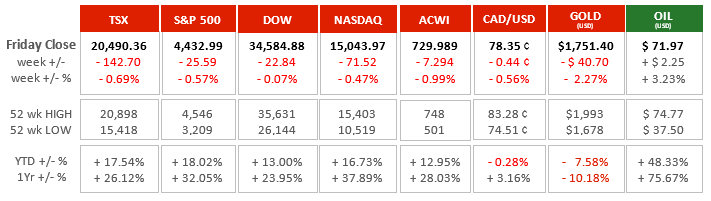

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Losses in equities for the second consecutive week were not as severe as the previous week. The year-over-year (1Yr) advances remain in the 24 – 38% range, and so far, year-to-date (YTD) equities have gained between 13 -18%. Inflation fears and resultant monetary policy responses have heavily influenced markets lately.

- Inflation in Canada surged to its highest level since 2003 as prices in August rose 4.1% compared with a year earlier. Comparing July 2020 to July 2021 the inflation rate was 3.7%. August becomes the fifth consecutive month where inflation exceeded the Bank of Canada’s target annualized year-over-year rate of 2%.

- In the U.S. year-over-year inflation rate fell slightly from 5.4% in July to 5.3% in August. The month-to-month inflation rate also declined. Prices rose 0.3% in August compared to July, down from 0.5% for the period of June to July. This very slight moderation, and the lower core rate of inflation at 4.0% for August versus 4.5% for July, supports the Federal Reserve’s position to maintain current programs.

What’s ahead for this week?

- In Canada, retail sales for July and the new housing price index for August will be released. The Federal government has tentatively scheduled a release of July’s budget balance. A summary of party stances on election issues can be found here.

- In the U.S., housing starts, building permits, existing home sales for August will be announced. The Chair of the Federal Reserve, Jerome Powell, will speak following the Federal Open Market Committee’s announcement of monetary policy and an update to economic projections.

- Globally, capital markets are closed at the beginning of the week in Japan and China. Eurozone consumer confidence, manufacturing and service Purchasing Managers Indices (PMI) will be released. The Bank of England will announce its monetary policy, and the European Central Bank released its economic projections.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.