IAIC Market Update - November 7, 2022

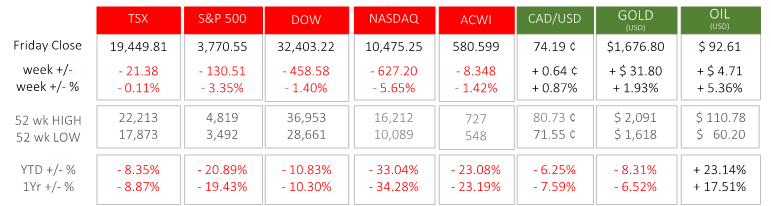

Last Week in the Markets: October 31st – November 4th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- On Wednesday afternoon the Federal Reserve delivered its interest rate decision. Chair, Jerome Powell, announced a 75-basis point (¾%) rise to increase the monetary policy battle against inflation. (Source1, Source2)

- The first four days brought losses to North American equity indices, and Friday’s lift of 1% for each index prevented the week five days of losses. Friday’s reversal was initiated by employment news announced before markets opened.

- In the U.S., 261,000 new jobs were created in October mostly in health care, services, and manufacturing. Labour force participation remained unchanged while the unemployment rate rose 0.2% to 3.7%. In Canada, employment rose by 108,000 in October, recouping job losses that occurred between May and September. The construction, manufacturing and accommodation and food services added jobs, while wholesale and retail trade lost jobs. Unemployment was unchanged at 5.2%.

- The strong employment numbers on both sides of the border are worrying to central bankers, and continue to add certainty to more rate hikes, which is increasing fears of recession. Although, equities moved higher on Friday the overall direction was downward based on the reality and prediction of rate increases, and plentiful jobs. (Source1,

Source2,

Source3)

What’s ahead for this week?

- In Canada, a week with no significant economic announcements concludes with Remembrance Day observances on Friday.

- In the U.S., several Governors from the Federal Reserve will be delivering speeches that could provide additional insight to the recent interest rate increase. The Consumer Price Index (CPI) and Core CPI for October will be released. The U.S. federal government will announce the Budget Balance, and crude oil, gasoline, heating oil and natural gas inventories.

- Globally, Germany’s industrial production and CPI for October, France’s imports, exports and trade balance, and the Eurozone’s retail sales for September will be announced. China’s trade balance, CPI and PPI are scheduled for release.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.