IAIC Market Update - November 14, 2022

Last Week in the Markets: November 7th – 11th, 2022

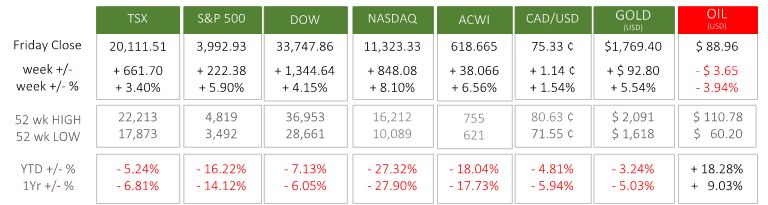

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- U.S. consumer inflation was released midweek and generated a rebound from recent losses. Price increases were below expectations at 0.4% for October and 7.7% on a year-over-year basis. The monthly increase repeated September’s level while annual inflation fell to its lowest level since January, and 1½% below June’s recent peak.

- The major contributors to inflation remain housing, food, and gasoline. Inflation exists across a broad array of goods and services, and the drop in the annual inflation in October has not significantly reduced the overall inflation rate relative to the long-run average target set by the Federal Reserve of 2%.

- Caution should still be exercised with inflation still running very high and the jobs market still strong. With little ‘slack’ created in the jobs market it will be difficult for inflation to fall back toward target levels that will eliminate the need for monetary policy action.

- Markets reacted with optimism when North American equity indexes posted their best trading day since 2020 by jumping 3½ to 7½% on Thursday.

What’s ahead for this week?

- In Canada, the week begins with a speech by Bank of Canada Governor, Tiff Mackle. The economic indicators scheduled include manufacturing and wholesale sales, housing starts and CPI for October.

- In the U.S., it will be the Producer Price Index (PPI) and import and export price indices that are released to measure American inflation. Retail sales, capacity utilization, industrial and manufacturing production, business, gasoline, crude oil inventories, building permits, housing starts, and existing home sales will also be announced in a busy week for economic reporting.

- Globally, the Eurozone will release its trade balance, industrial production, Q3 employment and Gross Domestic Product and CPI for the region as well as France and Italy, individually. China will announce retail sales, house prices, and industrial production. Japan will report its GDP, capacity utilization, industrial production, trade balance and consumer inflation.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.