IAIC Market Update - November 15, 2021

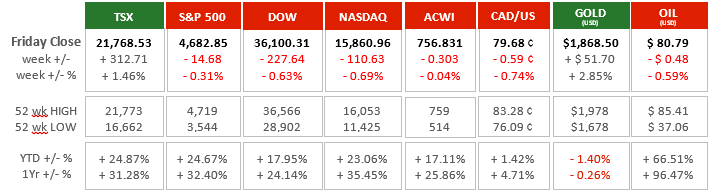

Last Week in the Markets: November 8th - 12th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- In a week where bond markets closed on Thursday for the observance of Remembrance Day, the TSX gained while the S&P 500, the Dow and NASDAQ all lost ground. The TSX has returned almost 25% in 2021 and has edged ahead of the S&P 500 and NASDAQ in year-to-date returns.

- Equities in the U.S. have been negatively affected by the recent release of consumer and producer inflation numbers. The Consumer Price Index (CPI) has risen to 6.2% in October and the Producer Price Index (PPI) is at 8.6% in the U.S. The CPI last reached this level in 1990 and it has been more than a decade since the PPI has been this high. The Canadian inflation rate will be updated on Wednesday but had been trailing the U.S. at 4.4% in September. Prior to the pandemic and since 2010 inflation in Canada and the U.S. had averaged 1.6%.

- Both countries’ inflation rates are well above the desired long-run average of 2%. In theory, inflation would hover at or near 2%, with equal amounts of time spent above and below the goal of 2%. When the rate exceeds four, five and six percent, the goal can only be achieved after sustained periods under the goal.

- It appears that the U.S. Federal Reserve and the Bank of Canada will be pressured to raise interest rates sooner than were anticipated only a few weeks ago as inflation appears to be more persistent than transitory. (Source1,

Source2)

What’s ahead for this week?

- In Canada, September retail sales, manufacturing sales, new orders and wholesale trade, , will be announced. Existing home sales, housing starts and new housing price index for October will be released along with consumer inflation for the same period.

- In the U.S., October data will be released for several economic indicators including retail sales, import prices, industrial production, capacity utilization, business inventories, housing starts and building permits.

- Globally, Gross Domestic Product growth and inflation, through their respective CPIs, will be released for Japan, the Eurozone. China is scheduled to release its retail sales and industrial production.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.