IAIC Market Update - May 10, 2021

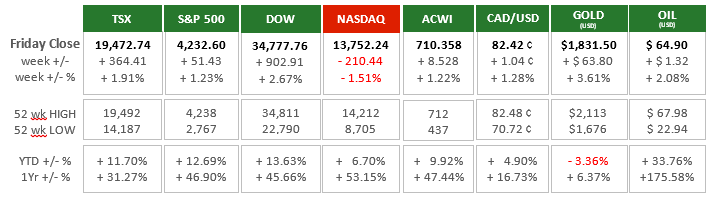

Last Week in the Markets: May 3rd - 7th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

North American equities did well last week except for the NASDAQ index which experienced a rare, negative reversal.

- The NASDAQ’s technology firms, especially the largest like Facebook, Amazon, Alphabet (Google) and Microsoft, have not delivered the performance lately that has allowed the index to outperform others in the past year.

- The week also ended with pessimistic and disappointing employment news. Renewed pandemic restrictions for Canadians were implemented in April leading to 207,000 job loses, about 35% more than expected.

- In the U.S. 266,000 new jobs were added when about 1 million additional jobs were expected. Instead of increasing the number of new jobs from March’s result of 770,000, employment growth fell by about 200,000 jobs. About 7 million less jobs exist today than before the pandemic began.

- The unemployment rate in the U.S. stands at 6.1% and 8.1% in Canada. The rates do not seem as discouraging as expected, however, as these indicators are lower because labour force participation has fallen.

- About two-thirds of North American Gross Domestic Product (GDP) is comprised of consumer spending. The purchase of products and services by individuals and families is the largest contributor to GDP. Consumers without income (i.e. jobs) will exhaust their savings and stall economic recovery. Monitoring job data domestically and internationally is critical to understanding progress against the pandemic.

What’s ahead for this week?

- In Canada, the Bank of Canada Governor, Tiff Maklem, will hold a webcast where he will review the central banks actions and lay groundwork for upcoming measures. March’s industrial price index, manufacturing sales and new orders and wholesale trade information will be released.

- In the U.S., inflation figures for April will be released through the Consumer Price Index (CPI). Budget deficit figures, retail sales, import and export price indices, industrial production and business inventories are also scheduled for release.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.