IAIC Market Update - March 15, 2021

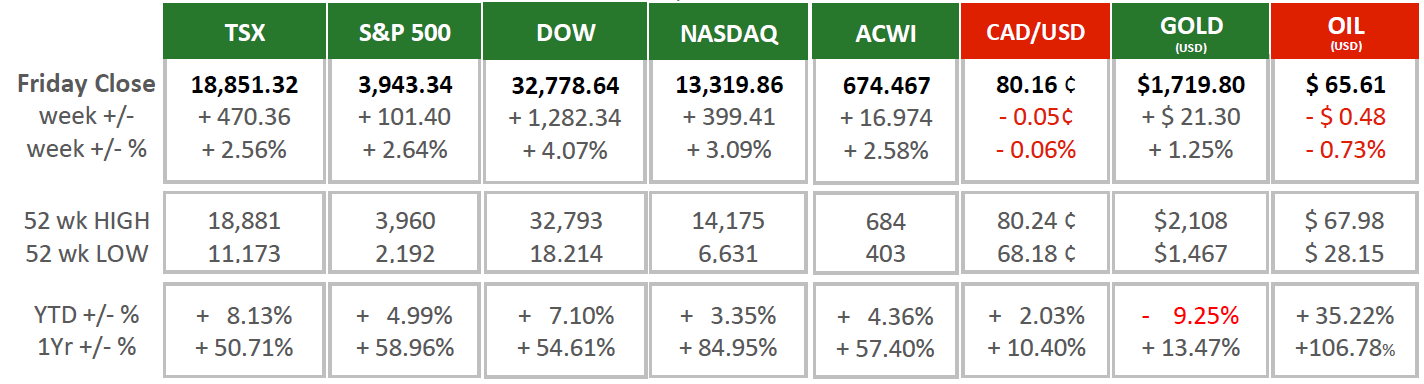

Last Week in the Markets: March 8th - 12th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- North American and global equities gained ground last week due to positive economic announcements and legislative events.

- Indicators show that growth in the inflation rate have slowed or are lower than predicted. Consequently, central banks are not expected to take any action that would slow economic growth while tamping down inflation.

- The Bank of Canada held its interest rate and bond-buying program steady in its announcement on March 10th.

- The U.S. Covid-relief bill passed through Congress and was signed into law. The $1.9 Trillion bill contains multiple measures, including rent relief for individuals and businesses, increases for consumer spending with direct payments to households, and additional Democrat-led initiatives to assist lower income individuals.

- The Organization for Economic Cooperation and Development (OECD) has increased its forecast for global GDP growth for this year. Applications for unemployment benefits fell to levels not seen since November and job openings are rising faster than expected according to the U.S. Bureau for Labor Statistics.

- All of these factors contributed to last week’s success for equities as record highs for the Dow Jones Industrial Average, S&P 500, Canada’s TSX and Germany’s DAX were reached.

What’s ahead for this week?

- In Canada, February housing starts, home sales and average price will be announced along with inflation through the Consumer Price Index. January data will be released for Canadian retail sales and manufacturing sales and new orders.

- In the U.S., retail sales, industrial production and capacity utilization, building permits and housing starts for February will be released.

The latest details from the Canadian Federal Government on stimulus and economic assistance are available here.

The latest details of the current Canada’s Covid-19 Economic Response Plan are available

here.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.