IAIC Market Update - June 28, 2021

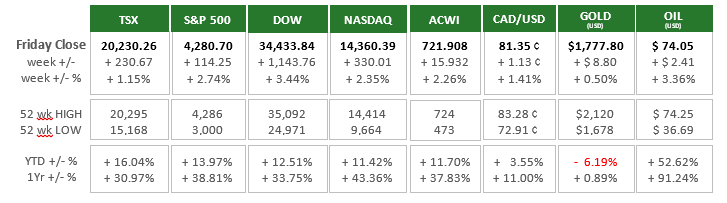

Last Week in the Markets: June 21st - 25th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The S&P 500 reached a new all-time high last week, indicating that monetary policy jitters may be temporary. In the U.S., banks passed stress tests and President Biden passed his infrastructure plan.

- In Canada, the latest jobs figures are more optimistic. After losing 207,000 jobs in April the loss of 68,000 jobs was less severe. The unemployment rate rose in May to 8.2% from April’s 8.1%. Labour force participation is a little troubling as youth and women are no longer seeking employment due to the adverse business conditions. Overall 570,000 less jobs exist in Canada from pre-pandemic levels, but that number is expected to fall sharply as more Covid-19 restrictions are lifted.

- In the U.S. nearly 600,000 jobs were added in May as reopening continues. The jobs and Gross Domestic Product rebounds in the U.S. should effectively foreshadow the long-term expansion globally as the pandemic ends and the virus is controlled.

What’s ahead for this week?

- In Canada, real GDP for April will be announced showing the effects of pandemic restrictions. Also the industrial and raw materials price index, merchandise trade balance, building permits for May and the Markit Purchasing Managers Index (PMI) for June will be released. Domestic markets will be closed on Thursday for Canada Day.

- In the U.S., the economic release calendar includes May’s factory orders, pending home sales and construction spending. Data for June will focus on employment with ADP’s national employment report and the Bureau of Labor Statistics’ non-farm payroll reports where 700,000 new jobs are predicted compared to May’s 559,000.

- Globally, a number of important indicators will be announced, Japan’s PMI, jobless rate, retail sales, industrial production and consumer confidence, Eurozone’s PMI, consumer and producer price indices (CPI and PPI), economic and consumer confidence, Germany’s CPI, unemployment, and retail sales. Lastly, expect oil prices to react to the upcoming OPEC+ meeting.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.