IAIC Market Update - June 21, 2021

Last Week in the Markets: June 14th - 18th, 2021

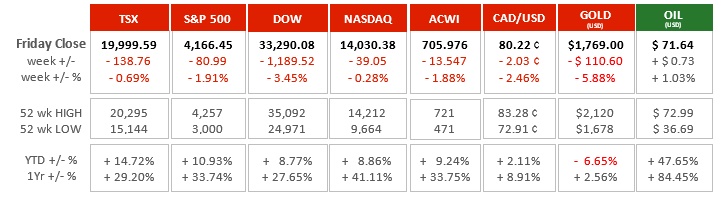

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Major North American equity indices, the Canadian dollar and Gold had a disappointing week: Gold dropped by nearly 6%, while equities lost between ¼% and 3½%.

- Much of the turmoil and negative results are being attributed to the U.S. Federal Reserve’s statements on Wednesday. Although interest rates remain unchanged, the spectre of inflation was prominent in the announcement by Jerome Powell, Fed Chair, and will influence the timing of future interest rate increases according to Powell’s press conference.

- The Fed has two primary mandates, control inflation and maximize employment.

- The Fed is watching inflation closely and is willing to risk reversing employment gains as recovery from the pandemic continues in order to stifle inflation. The latest announcement from the Federal Open Market Committee (FOMC) states, “the Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.” Since inflation has been below 2%, it will be allowed to float above 2% for some time to arrive back at the 2% average for the longer term.

- Federal Reserve expects to increase interest rates in 2023, and perhaps twice. (Source)

- Canadian inflation for May was 3.6%, a slight increase from April’s 3.4%.

- The Bank of Canada has had a similar stance as the Federal Reserve regarding inflation. Inflation will eventually cause interest rate increases if it exceeds targets. However, both the Canadian and American central banks are similarly cautious and take action after deliberation.

- The recovery is not complete and measures, like an interest rate increase, that are intended to reduce inflation by slowing the economic rebound will not be viewed favourably by most but will be necessary at some point in time.

What’s ahead for this week?

- In Canada, April figures for employment and jobs will be released along with retail sales for the same period. May’s wholesale trade and manufacturing sales are also scheduled for release.

- In the U.S., existing and new home sales, wholesale and retail inventories, durable goods orders and personal income and spending for May are scheduled for release. Also, first quarter data for real Gross Domestic Product (GDP) and pre-tax corporate profits will be announced.

- Globally, Eurozone consumer confidence, purchasing managers index (PMI) and money supply information is on the calendar. Japanese PMIs and retails sales figures will also be announced.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.