IAIC Market Update - July 4, 2022

Last Week in the Markets: June 27th – July 1st, 2022

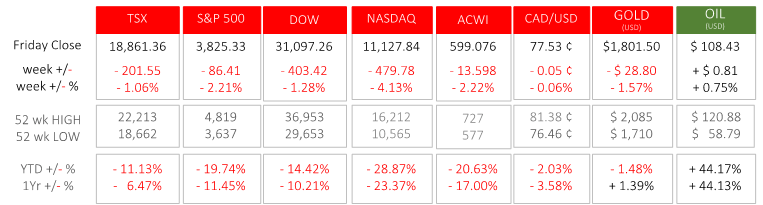

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The first half of 2022 concluded with the major indices losing 11% to 29% of their value over the past six months, and 6% to 23% over the past full year.

- The S&P 500 is now considered to be in a bear market having declined 20%.

- Gold has held its value as a safe-haven investment with a loss of 1½% this year and a gain of almost as much year-over-year. Energy prices (i.e., oil) have rebounded this year and over the past year from about $75 per barrel to $108. Unfortunately, the prices of oil, gas and gasoline are major contributors to the high rates of inflation continuing to be felt around the world. The war in Ukraine, struggling supply chains, and high employment levels with rising wages have pushed consumer inflation to levels not seen in four decades.

- Continuing a strong and disciplined approach remains important as the second half begins.

What’s ahead for this week?

- In Canada, the Bank of Canada will release its Business Outlook. May building permits, imports, exports and trade balance will be announced along with June employment, unemployment, labour force participation rates.

- In the U.S., markets will be closed on Monday to observe Independence Day. The week’s announcements will include durable and factory goods orders, mortgage market data, imports, exports and trade balance, purchasing managers indexes (PMIs), and non-farm payrolls and wages.

- Globally, a broad range of indicators will be released in Europe including German imports, exports and trade balance, French current account and industrial production, Italian and German goods and services PMIs. The head of the European Central Bank will make an announcement and release its monetary policy meeting minutes.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.