IAIC Market Update - July 11, 2022

Last Week in the Markets: July 4th – 8th, 2022

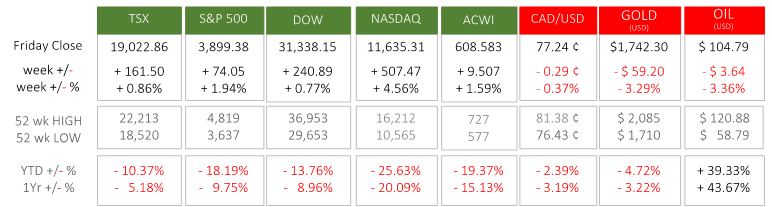

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a minor turnaround for equity investors. After major losses year-to-date and year-over-year, some positivity returned to North American indexes as they delivered modest gains. The increases were 1 – 2% for the TSX, Dow and S&P 500 and nearly 5% for the NASDAQ for a 4-day week in U.S. that followed Monday’s Independence Day.

- The week concluded with Friday’s announcement that 372,000 jobs had been added to the U.S. economy in June. That number is just slightly below the 3-month rolling average of 375,000 and was welcome news for markets. U.S. unemployment sits at a 50-year low of 3.6%. In Canada the unemployment rate reached a new record low of 4.9% after the addition of 43,000 jobs and a reduction in labour force participation. The fear is that recent central bank actions will push the economy into recession, but the robust jobs market suggests that a recession, if it is coming, has not arrived, yet. (Source)

- Inflation remains high and interest rates will continue to be raised to battle it. The trade-offs among inflation, jobs and economic growth will continue for the next few months and quarters. Should the tightening by central banks like the Federal Reserve push the American and global economy into recession, sentiment is growing that it could be shallow and short-lived. Should it occur equity markets will suffer again, but a smaller and less persistent recession would not affect markets as deeply as first predicted.

What’s ahead for this week?

- In Canada, the Bank of Canada will release its interest rate decision at 10 am on Wednesday. Analysts expect an increase, but the size of the increase at 50 or 75 basis points is being debated.

- In the U.S., the major news will be the release of the Consumer Price Index (CPI) on Wednesday morning followed by the Producer Price Index (PPI) the following day. The consumer inflation levels will provide additional insight into coming Federal Reserve actions regarding inflation control. The next scheduled opportunity to adjust interest rate is set for July 27th.

- Globally, Japan’s machine tool and machinery orders and Producer Price Index, China’s imports, exports and trade balance, and U.K.’s Gross Domestic Product, industrial and manufacturing production will be announced. Consumer inflation in France, Germany, Spain will be released.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.