IAIC Market Update - July 25, 2022

Last Week in the Markets: July 18th – 22nd, 2022

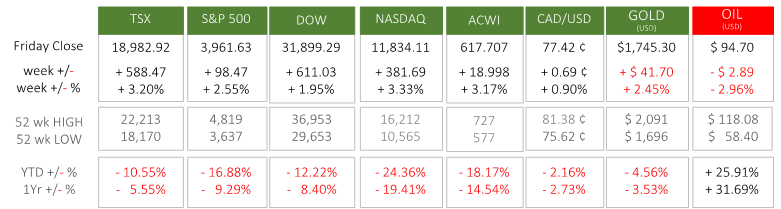

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Equities regained recent losses, but the major North American (DOW & NASDAQ) indexes remain 8-19% below their levels of one year ago, and 12-24% below their values year-to-date. Last week’s rally echoes small periods of gain that have occurred several times in 2022 (late January/early February, mid-March, second half of May), and perhaps again now. The recent positive results can be attributed to:

- Inflation, which likely has not peaked, is seeing its growth rate lessen, and wage growth, which contributes to inflation, has also slowed. Canadian consumer inflation hit a 39-year high at 8.1%, lower than expected. (Source)

- Commodity prices are continuing to fall (oil, metals, lumber, corn, wheat, soybeans), which broadly lowers inflationary pressure for end consumers as well as companies.

- The European Central Bank (ECB) raised its key interest rate for the first time in more than a decade by ½ percent (50 basis points). Inflation woes are being exacerbated by the weakening Euro, and this increase is the first step in the “further normalization of interest rates” (i.e., rising back to more typical and traditional levels) at upcoming ECB meetings. ECB Statement

- Volatility has increased recently, as evidenced by the rapid swing from declines to gains in equity markets. Year-to-date volatility is 39% higher. Goal-based planning and discipline remain paramount. (Source)

What’s ahead for this week?

- In Canada, Gross Domestic Product (GDP) figures for May will be announced along with the federal government’s budget balance for April.

- In the U.S., the most important announcement will arrive from the Federal Reserve’s FOMC on Wednesday when the latest monetary policy statement and interest rate decision is released.

- Globally, French, German, and Spanish GDP for the second quarter will be released. German and Italian CPI for July will also be announced.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.