IAIC Market Update - August 2, 2022

Last Week in the Markets: July 25th – 29th, 2022

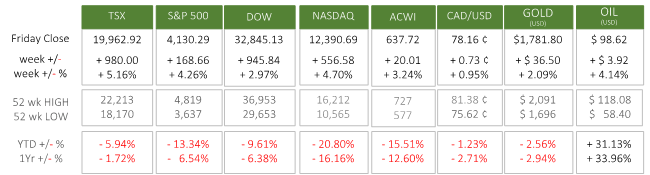

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The end of July provided positive results for all the indicators in the grid. Year-to-date the equity indexes still have losses, but they have been roughly halved lately. Several factors are working together to deliver these positive results:

- After raising benchmark interest rates by ¾ percent (75 basis points) July 27, 2022 the Federal Reserve indicated that interest rates would rise more gradually with smaller future rate hikes. (Source)

- The economy in both Canada and the U.S. is slowing, which permits the slowing of interest rate increases as the slowdown reduces inflationary pressure.

- Canadian Gross Domestic Product (GDP) remained unchanged in May as transportation, agriculture, accommodation, and food services expanded while manufacturing, construction, and mining contracted. (Source)

- Quarterly earnings reports from S&P 500 firms have been reduced, and several have missed predictions, most firms have exceeded lower expectations. More than 50% of S&P 500 firms have reported and nearly three-quarters of them have beaten estimates. Current earnings do not yet reflect increased interest rates.

- In both countries equity markets performed well on less than stellar news exemplifying the relativity between results and expectations, not results alone. It appears that last week’s news was better than expected and resulted in positive returns for most investors.

What’s ahead for this week?

- In Canada, markets were closed for the Civic Holiday on Monday August 1, 2022. Imports, exports, and trade balance will precede July’s employment report, which will signal the Canadian economy’s growth.

- In the U.S., several purchasing managers indexes (PMI) that signify corporate buying optimism for expansion will be released. Friday will include the announcement of the non-farm payroll report for July.

- Globally, the Eurozone will also announce imports, exports and trade balance, PMIs and June’s unemployment rate, retail sales and producer price index.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.