IAIC Market Update - January 3, 2023

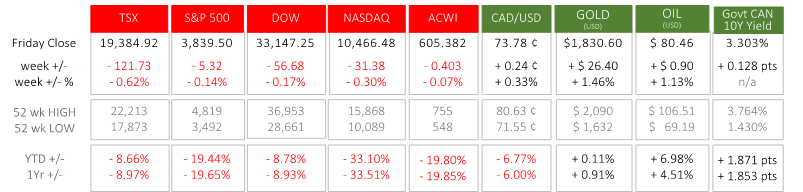

Last Week in the Markets: December 26th – 30th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a short week for Canadian traders with markets shuttered on Monday and Tuesday for the observance of Christmas Day and Boxing Day. U.S. markets do not observe Boxing Day.

- Despite the lower trading volumes typical for this period, the equity markets continued their recent path with additional losses. The North American indexes lost only small amounts during the most recent week but have lost substantial value over the past year. The TSX and Dow declined by nearly 9% for the year. The S&P 500 and NASDAQ lost nearly 20% and 34%, respectively over the last year.

- Since the last Weekly Market Update two important indicators were released in Canada.

- November’s consumer inflation data was reported on December 21st. The year-over-year rate in November was 6.8%, following October’s 6.9% annual increase. Gasoline prices fell 3.6% in November and are up by 13.7% over the past year. Grocery prices have risen 11.0% year-over-year, and prices for housing have risen 7.2% over the same period as mortgage rates and rents rose. (Source)

- On December 23rd Gross Domestic Product (GDP) numbers showed the Canadian economy had grown 0.1% in October, down from September’s 0.2%. Service industries (arts, entertainment, recreation, accommodation, food services, transportation, warehousing, and the public sector) expanded, while mining, oil, gas, and manufacturing declined. (Source)

- The “third estimate” of U.S. third quarter GDP was announced on December 22nd and showed that the economy expanded at an annualized rate of 3.2% during Q3 after declining 0.6% in Q2. (Source)

- The progress of monetary policy against inflation and on economic output (i.e., GDP) will guide markets well into 2023.

What’s ahead for this week?

- In Canada, on Friday the latest employment numbers, for December, will be released. The strength (or weakness) in the numbers may foreshadow Bank of Canada monetary policy decisions.

- In the U.S., December’s jobs information, labour force participation and unemployment rate will be reported by the Bureau of Labor Statistics on Friday.

- Globally, consumer inflation data will be announced for Germany in particular and the entire Eurozone more generally. Like other jurisdictions, inflation numbers will influence central bank policy.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.