IAIC Market Update - January 25, 2021

Last Week in the Markets: January 18th - 22nd, 2021

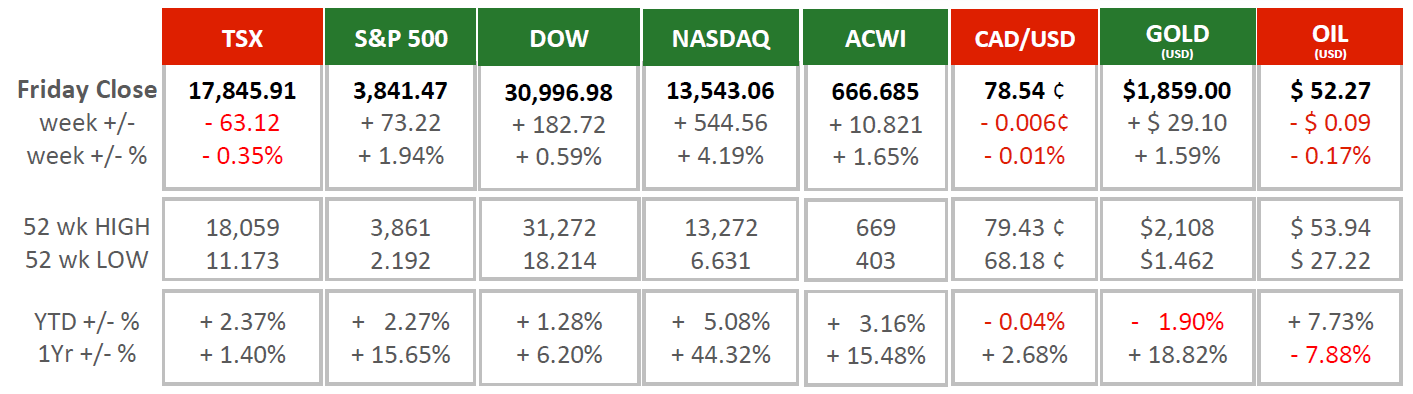

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Joe Biden Jr officially became the 46th President of the United States.

- Biden signed nearly twenty Executive Orders; reversing many of his predecessor’s policies and signing new orders to combat the coronavirus by increasing the manufacturing of protective equipment, vaccines and testing, requiring masks on Federal property and during interstate travel, and identifying additional treatment options.

- One of the executive orders revoked permission for the Keystone XL pipeline. President Obama’s decision to ban cross-border shipments via this pipeline was reversed by Trump, and then reversed again by the new President of the United States. The strength of this action based on its timing and lack of consultation with Premier Kenney or Prime Minister Trudeau suggests that there is little appetite for Biden and the US to negotiate this decision. (Source1, Source2)

- The Bank of Canada made its latest interest rate announcement amid the continuing environment of historically low interest rates. The “effective lower bound” has described the overnight rate at ¼ of a percent. The possibility of a “micro cut” had been the subject of speculation ahead of the Bank’s decision to hold the rate unchanged. (Source1, Source2)

What’s ahead for this week?

- In Canada, pandemic effects will be expressed in our economic activity as November’s Gross Domestic Product (GDP) is released. December’s building permits and raw materials price index is also scheduled for release.

- In the U.S., the Federal Reserve will release its interest rate decision on Wednesday. A number of indicators from December are also scheduled including durable goods orders, personal income and spending, and new home sales.

- On Monday the House of Representatives will be sending the Articles of Impeachment for Donald Trump to the Senate triggering a trial that is scheduled to begin on February 8th. (Source)

The latest details from the Canadian Federal Government on stimulus and economic assistance are available here.

The latest details of the current Canada’s Covid-19 Economic Response Plan are available

here.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.