IAIC Market Update - February 21, 2023

Last Week in the Markets: February 13th – 17th, 2023

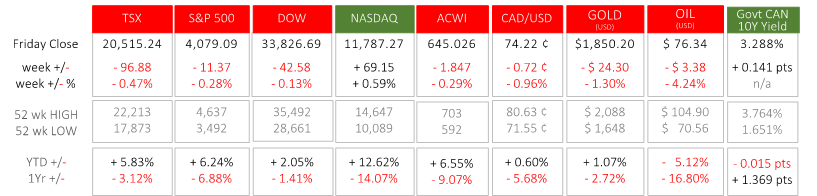

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The major North American indexes peaked on Wednesday and then delivered two days of negative returns to close the week prior to the Canadian and U.S. holiday observances on Monday. The most important economic news affecting capital markets was focused on U.S. consumer and producer inflation, and the implications for the next round of Federal Reserve monetary actions scheduled for March 22nd.

- The Consumer Price Index (CPI) rose 0.5% in January after rising 0.1% in December. The year-over-year inflation rate is 6.4%. Over half of the monthly rise was contributed by shelter, and food, gasoline and natural gas also pushed price increases along. The Producer Price Index (PPI) increased by 0.7% in January, which follows a decline of 0.2% in December. For the 12 months ending January 31st, the PPI has risen 6.0%.

What’s ahead for this week?

- In Canada, Monday’s holiday had markets closed. Starting on Tuesday with the release of the latest consumer inflation data, retail sales, new housing price index, manufacturing and wholesale sales and the federal government’s budget balance will be reported.

- In the U.S., markets were closed for President’s Day. Existing home sales, mortgage market index, consumer and personal spending will be announced. The Department of Commerce will release the Personal Consumption and Expenditure (PCE) price index, the key inflation indicator for the Federal Reserve.

- Globally, the Eurozone will release its regional Consumer Price Index (CPI), which incorporates the inflation across all economies in their organization. Germany, the largest European economy, will release its Gross Domestic Product (GDP) for Q4. Japan will also release its consumer inflation data.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.