IAIC Market Update - August 9, 2021

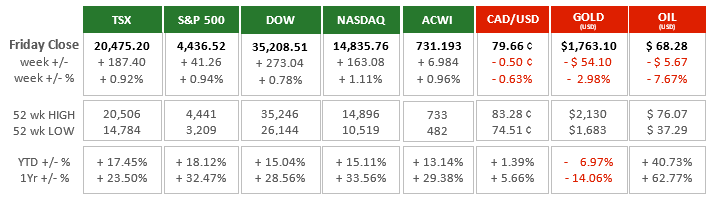

Last Week in the Markets: August 2nd - 6th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a strong week for equities compared to commodities; Canada’s TSX, America’s S&P 500, Dow, and NASDAQ, and the global MSCI All-Country World Index each gained 1% over the past five-day trading session.

- Gross Domestic Product (GDP) and employment expansion continues to drive equity market gains. In the U.S. GDP has grown 6.4% during 2021, and Canadian GDP has grown by more than 5% in the first quarter as we await Q2 GDP numbers domestically. July job growth has been strong in both countries with 94,000 new jobs in Canada and 943,000 in the U.S. The unemployment rate in Canada has fallen to 7.5% and 5.4% in the U.S.

- Strong jobs growth combined with increasing wages could drive inflation concerns. This week, China, Germany, U.S., and Canada will announce inflation numbers for July, and we will see whether these concerns are justified, and eventually whether monetary policy will be affected. For the near future it appears that bond-buying programs and interest rates will be held steady by central banks around the world.

- Should inflation numbers be higher than expected (or above the desired range set by central bankers) most analysts believe that action will be delayed until the impact of the delta variant of Covid-19 is known. As we wait, the measures in-place by the Bank of Canada, the Federal Reserve and other banks will continue to support equities markets.

What’s ahead for this week?

- In Canada, producer inflation will be the lone indicator of importance on the economic release calendar.

- In the U.S., job openings and labor turnover for June is scheduled for release and second quarter productivity. July’s consumer and producer inflation will be announced.

- Globally, the Tokyo Olympics concluded on Sunday and Japanese markets will be closed on Monday. China will release its latest inflation numbers through the Consumer and Producer Price Indices. Germany will also release its inflation data.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.