IAIC Market Update - August 17, 2021

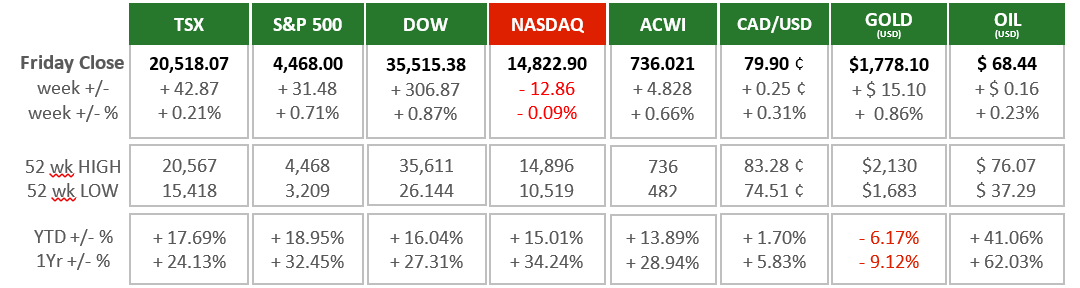

Last Week in the Markets: August 9th - 13th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- U.S. consumer inflation rate for July was released this past week.

- Prices rose 5.4% higher than the previous year.

- The core inflation rate that excludes food and fuel rose 4.3%, which was slightly lower than June’s year-over-year increases.

- Categories that are closely associated with reopening, and have had large increases in previous months, have slowed their rise and in some cases retreated.

- Overall, the increases were in-line with expectations and the slowing of price increases is excellent news.

- The Federal Reserve is watching inflation very closely and has portrayed that these larger than desired inflation numbers as temporary and would moderate quickly. It appears that the Fed has been correct, and its watching-and-waiting approach to monetary policy changes has been prudent.

- Equity markets have responded favourably with new highs achieved for major indices in the U.S. and Canada. Despite a small loss for the NASDAQ last week, the major indices have risen 15% to 19% in 2021. MSCI’s All-Country World Index (ACWI) has gained nearly 14% over the same period, which is remarkable with the inconsistency of economic recovery based on vaccination rates around the world.

- Another positive contributor for equity markets in North America last week was the predicted increase in fiscal spending by the U.S. federal government. The Senate passed a bipartisan infrastructure bill as a larger $3.5 Trillion package is pursued by Democrats, causing additional negotiation and perhaps delay.

- In Canada, the spending continues to accelerate by the governing Liberals. The trend could be in jeopardy if their negotiated mandate with the NDP ends following the next election.

What’s ahead for this week?

- In Canada, last week’s light calendar for economic announcements rebounds with a full slate, including June’s manufacturing sales, wholesale trade, new orders and retail sales, July’s housing starts and existing home sales.

- In the U.S., after last week’s important news regarding domestic inflation, the calendar is lighter with July’s retail sales, industrial production, housing starts, and Federal Reserve meeting minutes scheduled for release.

- Globally, production and inflation will dominate the news with China’s retail sales, industrial production, Japan’s real GDP, inflation, trade balance and industrial production and the Eurozone’s real GDP and inflation scheduled.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.