IAIC Market Update - August 8, 2022

Last Week in the Markets: August 1st – 5th, , 2022

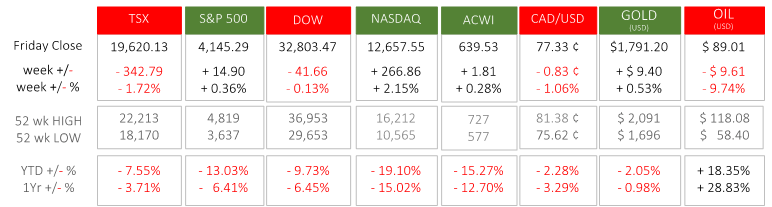

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The news last week centred around jobs reports and quarterly earnings for the S&P 500, and their implications for upcoming monetary policy balanced against current corporate performance.

- “Employment in Canada was little changed (-31,000) in July, and the unemployment rate was unchanged at 4.9%” according to July's Labour Force Survey released by StatsCan. The services sector lost jobs, while the goods producing sector added employment. The unemployment rate maintained its record low, and long-term unemployment fell 23,000 as average hourly wages rose 5.2% on a year-over-year basis. (Source)

- In the U.S., “total non-farm payroll employment rose by 528,000 in July, and the unemployment rate edged down to 3.5 percent” the Bureau of Labor Statistics reported in their Employment Situation Summary. Long-term unemployment is below February 2020 levels, and temporarily laid-off workers have returned to pre-pandemic levels at 791,000. The American economy has now regained the 22 million jobs that were lost in early 2020 when the pandemic was beginning. (Source)

- Additionally, second quarter earnings of the S&P 500 companies that have reported so far show profits are up nearly 7% over last year. (Source)

- The robust U.S. jobs market and strong earnings show that central bank actions have not taken effect yet. The continued strength in U.S. jobs and the indication that employment is growing rapidly could spur the Federal Reserve to continue to act aggressively at its next monetary policy meeting in September.

- Consequently, markets were mixed with strong performance providing some positive influence while the threat of tightening monetary policy delivers a negative tone. This positive/negative teeter-totter will likely continue for the next few months.

What’s ahead for this week?

- In Canada, the next major economic announcement will occur on August 16th with the release of July’s consumer inflation. The next scheduled opportunity for the Bank of Canada to adjust monetary policy in response to inflation is September 7th.

- In the U.S., another week of important economic news follows as the latest Consumer Price Index (CPI) with month-to-month and year-to-year inflation numbers being released on Wednesday. The Producer Price Index (PPI) and Import and Export price indices will also be released.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.