IAIC Market Update - August 15, 2022

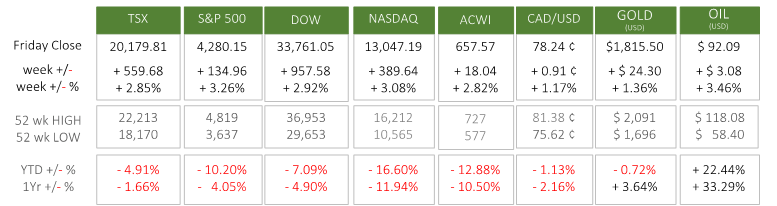

Last Week in the Markets: August 8th – 12th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Markets reacted swiftly to the better-than-expected and declining U.S. consumer and producer inflation news released last week. The year-over-year rates of inflation represented by the Consumer Price Index (CPI) and Producer Price Index (PPI) fell slightly. Inflation was expected to have risen last month. Prices for consumers were unchanged in July compared to June and the year-over-year inflation rate dropped from 9.1% to 8.5%. Prices for producers rose 9.8% in July on an annualized basis, which is below the reading in June of 11.3%. The response from equities was overwhelmingly positive

- Even at this lowered level, inflation remains historically high and well beyond the Bank of Canada and Federal Reserve’s 2% target level and 1 to 3% range. The Fed is expected to continue to raise interest rates, but the lessening of inflation suggests that interest rates may not be raised as quickly or as high.

- The market has priced-in a 50-basis point (0.50%) increase by the Federal Reserve to its federal funds rate at its next monetary policy meeting on September 21st. The Bank of Canada will provide its next interest rate and monetary policy update on September 7th.

- Policy rates are expected to rise to about 3½ or 3¾% before pausing in 2023, allowing time for the interest rates to affect the economy. The Federal Reserve is also ending its bond-purchasing program, which had provided additional liquidity to capital markets. This "quantitative tightening" will also work to slow the growth of the economy and in-turn inflation.

- Corporate returns are expected to follow the path of the economy and inflation and have profits pressured downward by the economic slowdown.

What’s ahead for this week?

- In Canada, manufacturing, wholesale, and retail sales will be announced tomorrow. July’s consumer inflation will be released on August 16th.

- In the U.S., building permits, housing starts, existing home sales, industrial production, capacity utilization, manufacturing production, business inventories and retail sales will be released, and form a wide representation of economic health.

- Globally, Japan’s Gross Domestic Product (GDP), capacity utilization, industrial production, machine orders and consumer inflation will be announced. China’s house prices, industrial production, retail sales and unemployment figures are scheduled for release. The Eurozone’s GDP and consumer inflation, two very important economic indicators will be announced this week.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.