IAIC Market Update - August 29, 2022

Last Week in the Markets: August 22nd – 26th, 2022

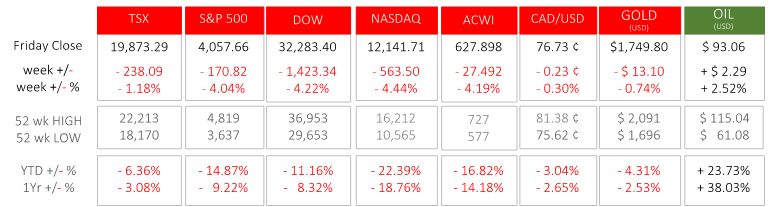

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- After a short rally on Wednesday and Thursday, equity markets stumbled on Friday. At 10 am Eastern, Jerome Powell, Chair of the U.S. Federal Reserve Bank delivered brief remarks at the annual Jackson Hole Symposium. He believes that the benchmark “federal funds” rate has reached its long-run neutral level, and further rate increases will be required to return consumer inflation to the Fed’s long-term target of 2%. In a shorter, more narrowly focused, and direct message, he stated that three lessons from previous periods apply to the current situation:

1. Central banks can and should take responsibility for low and stable inflation. Although, the Fed’s actions only address the demand-side of the supply/demand imbalance that is driving current inflation, their responsibility is not reduced.

2. The public’s expectations about future inflation can play a key role in setting the path of inflation over time. The anticipation of high inflation can become entrenched in decision making for businesses and households, because “inflation feeds, in part, on itself”.

3. The Federal Reserve “must keep at it until the job is done”. The Fed must act with resolve now by taking forceful and rapid steps to moderate demand, align it with supply, and lower expectations of high inflation.

Powell’s full remarks can be found here.

- The remarks, which indicated that interest rates will go higher and remain high until inflation is tamed, caused equity markets to drop. The S&P 500 tumbled 3.4%, the Dow fell 3%, the NASDAQ lost 3.9%, while the TSX dripped 1.5% on Friday following Powell’s speech. (Source)

What’s ahead for this week?

- In Canada, Gross Domestic Product for June and for the second quarter will be released with July’s building permits, manufacturing Purchasing Managers Index (PMI) and labour productivity.

- In the U.S., following the Fed’s Jackson Hole meeting several members of the FOMC (Brainard, Barkin, Bostic, Williams) will deliver speeches this week. The JOLTs job opening, housing price index, mortgage marketing and mortgage refinance indexes, PMIs, factory orders and August non-farm payroll numbers will be released.

- Globally, Eurozone business climate, consumer confidence and consumer inflation expectation will be announced along with their consumer inflation figures. Also, Japan’s unemployment, industrial production, retail sales, housing starts, and construction orders will be released along with China’s industrial profit, manufacturing, and non-manufacturing PMIs.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.