IAIC Market Update - August 22, 2022

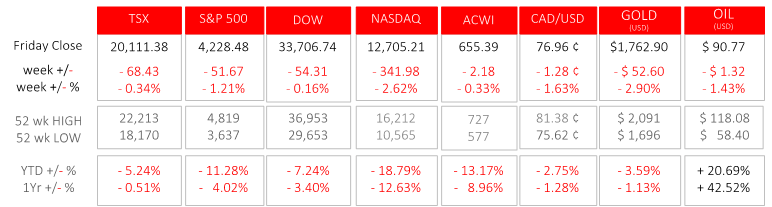

Last Week in the Markets: August 15th – 19th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Canadian consumer inflation data was released last week, and it continued the trend of tempering which is also occurring in the U.S. Falling gasoline prices offset rising food costs to drop July’s year-over-year inflation rate to 7.6%, down from 8.1% in June. For the seventh consecutive month, price rose on a month-to-month basis, but only slightly at 0.1% over the course of July. Gasoline prices dropped 9.2% in July while groceries (food bought at stores) rose by 9.4%. Even after removing the two most volatile categories, food and energy, consumer inflation is still running at 5.5%, which much higher than the Bank of Canada’s 2% target. (Source)

- The pressure on the Bank of Canada to rapidly raise interest rates is easing, but it has not abated as inflation is well above the 2% target.

- Rising interest rates resulting from monetary policy actions already undertaken by the Bank of Canada and the Federal Reserve have contributed to a slowdown in the U.S. housing market. In July, residential building permits fell by 1.3% overall and 4.3% for single family homes. Housing starts dropped 9.6% in July and have fallen by 8.1% compared to July 2021. Similar effects are expected to occur across Canada when comprehensive housing data is released here. (Source)

- The higher interest rates, which will increase further despite slowing inflation, are expected to negatively affect corporate earnings. The highly resilient corporate profits are predicted to fall as the second half of 2022 is reported. The equity markets reflected that sentiment last week. (Source)

What’s ahead for this week?

- In Canada, after several busy weeks for economic announcements, a light week is planned with the new housing price index, wholesale sales and the federal government’s budget balance scheduled.

- In the U.S., Purchasing Managers Indexes from PMI will be announced and accompany pending home sales, new home sales, durable goods orders, personal income and spending, and Gross Domestic Product for the second quarter. The Federal Reserve will hold its annual Jackson Hole Symposium.

- Globally, Japan’s Consumer Price Index and China’s industrial profit will be released. The European Central Bank will publish their monetary policy meeting minutes. Consumer confidence numbers will be announced by Italy, France, and Germany.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.