IAIC Market Update - January 24, 2022

Last Week in the Markets: January 17th - 21st, 2022

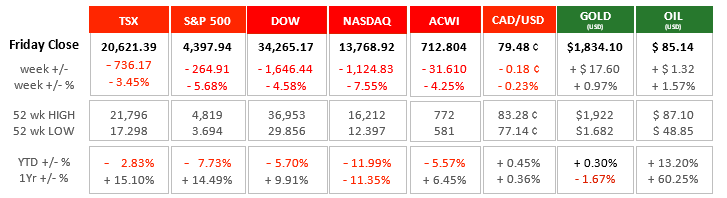

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a difficult week for most Canadian investors with broad equity holdings. After Monday, when the TSX rose 180 points and U.S. markets closed for Martin Luther King Day, it was four straight days of losses. For the week, the TSX dropped more than 3%, the S&P 500 fell nearly 6%, the Dow fell over 4%, and the tech-heavy NASDAQ fell over 7%.

- The most recent drivers of overall equity valuations are the continued rise of Omicron and consumer inflation that is pushing central banks to react with short term interest rate hikes sooner than expected. The Bank of Canada and the Federal Reserve have already reduced their support for long-term interest rates. Both institutions will announce their new monetary policy next week.

- U.S. Treasury rates have risen as high as 1.9% from 1.5% and are causing much of the recent equity volatility. The most reliable long-term indicator of equity performance is corporate performance. The corporate profits seen in 2021 will likely not be repeated this year. However, the predicted arrival of higher interest rates in the second quarter will likely not eliminate earnings growth either. (Source)

What’s ahead for this week?

- In Canada, December’s manufacturing sales and wholesale trade will be released. On Wednesday morning the Bank of Canada will deliver its monetary policy announcement and report.

- In the U.S., Purchasing Managers Indexes (PMI) will be released from Markit and December’s new home sales, goods trade deficit, wholesale and retail inventories will be announced. The Federal Reserve’s Open Market Committee will meet and announce their latest monetary policy on Wednesday afternoon as the quarterly corporate earnings season continues.

- Globally, PMIs will be released for several countries including Japan, the Eurozone and U.K. Germany’s GDP and Business Climate Report from Ifo. The Eurozone consumer confidence numbers are also scheduled.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.