Individual Pension Plans (IPP)

Dramatically boost your retirement assets with tax-deductible corporate contributions

How an Individual Pension Plan (IPP) works

An IPP is a tax-deferred savings vehicle used to invest and save for retirement. Contributions are tax-deductible and made directly from the corporation. Similar to an RRSP, the assets inside an IPP are tax-deferred until withdrawn, at which time they are treated as income.

How much can be contributed to an Individual Pension Plan?

Who is a good candidate for an Individual Pension Plan?

Business Owner

Registered Professional

Middle Aged Adult

T4 Earnings of $100k+*

*an IPP can be established for someone with lower earnings

Case Study

A business owner, aged 55, incorporated for 24 years, maximum T4 earnings of $178,600 with a current RRSP balance of $291,866.

- $156,600 in immediate past service funding, tax-deductible to the company

- $221,700 in qualifying transfer (from existing RRSP balance)

- Up to $446,211 more in tax-deductible contribution room over working years (excluding past service)

- The IPP balance could be up to $1,306,700 more than the RRSP balance

All the above figures are based on 2022 prescribed assumptions.

Advantages of an Individual Pension Plan

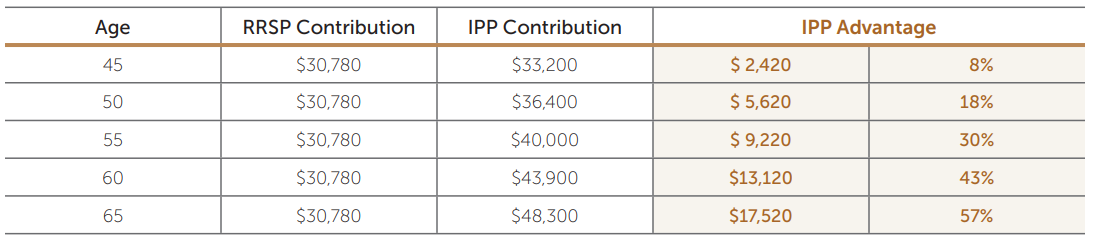

- Increased tax-deductible contribution room – up to 65% more than an RRSP

- Can reduce passive income in corporation

- Tax-deductible company contributions for prior years (past service)

- Richest benefit plan in Canada – 2% defined benefit pension plan

- All costs are tax-deductible to the company

- Creditor protection

- Increased corporate and personal tax savings

- Can include employed family members and pass on wealth to the next generation

Next Steps

Contact a Ward & Uptigrove Wealth Management representative at 519-291-3040 or email info@w-u.on.ca to learn more.