IAIC Market Update - September 26, 2022

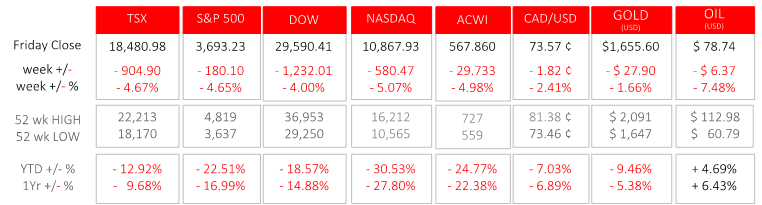

Last Week in the Markets: September 19th – 23rd, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Canadian consumer inflation for August led domestic news briefly. The Consumer Price Index (CPI) fell 0.3% in August and sits at 7.0% on a year-over-year basis. This is the second consecutive month when the annualized rate and month-to-month inflation has fallen.

- According to the StatsCan Release, much of the monthly decline can be attributed to the dropping price for gasoline, which lowered by 9.6% in August, but is still 22% higher than August 2021. Another contributor to slowing inflation was the cost of shelter, which has had its year-over-year rate drop from 9.7% in July to 7.4% in August. Food purchased in stores has risen 10.8% over the past year. (Source)

- On Wednesday the financial world was tightly focused on the U.S. Federal Reserve’s monetary policy announcement. For the fifth consecutive meeting, dating back to March 17th, the U.S. Federal Reserve has increased short-term interest rates. Following previous increases, the Federal Open Market Committee (FOMC) approved a third increase of ¾% (75 basis points) in a row. (Source)

- The Fed will “take into account a wide range of information, including readings on public health, labour market conditions, inflation pressures and inflation expectations, and financial and international developments” as it contemplates future monetary policy actions. Although the 75-basis point increase was widely expected, the commentary that accompanied the rate hike, that the Fed was committing to slowing inflation, and not as concerned about negative effects on jobs and economic output, contributed to much of the post-announcement losses. (Source)

What’s ahead for this week?

- In Canada, the most significant economic news scheduled is the release of July’s Gross Domestic Product (GDP) data. The federal government will also announce its Budget Balance for the same month.

- In the U.S., durable goods orders, new home sales and pending home sales for August will be released. More importantly, Q2 GDP and Personal Consumption and Expenditures Index will also be released.

- Globally, China will reveal its business confidence through several Purchasing Managers’ Indexes, including the especially important manufacturing sector. The Eurozone will release September’s Consumer Price Index and August’s unemployment rate.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.