IAIC Market Update - October 31, 2022

Last Week in the Markets: October 24th – 28th, 2022

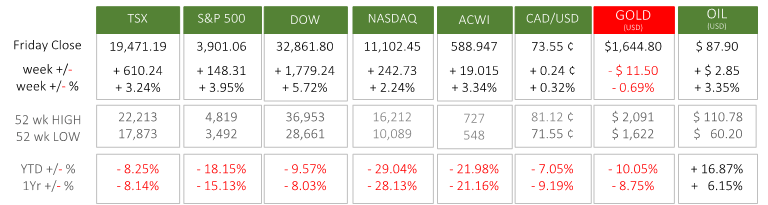

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The major and local economic news last week centred around the Bank of Canada’s interest rate announcement on Wednesday. The BoC increased the key lending rate by ½ percent (50 basis points), which now stands at 3.75%. It had been 0.25% until increases began on March 2, 2022.

- A heavy influence for the Bank of Canada occurred one week ago, when Canadian consumer inflation numbers were released on October 19th. Most analysts had predicted a larger increase even as inflation, the primary target of increased interest rates, has moderated slightly over the past three months. For September, the monthly inflation rose 0.1% while the year-over-year rate fell by 0.1% to 6.9%, down from 8.1% in June. (Source1, Source2)

- On Friday StatsCan announced Gross Domestic Product (GDP) for August, which increased by 0.1% over July. Services industries recaptured some earlier momentum while the production of goods faltered. (Source)

- In addition to the Bank of Canada’s rate increase, the European Central Bank (ECB) raised its benchmark rate by 75 basis points (¾ percent). (Source)

What’s ahead for this week?

- In Canada, September’s imports, exports and trade balance and October’s employment report are the most important economic indicators scheduled for release.

- In the U.S., the most significant news will occur on Wednesday afternoon when the Federal Reserve releases its latest monetary policy report and interest rate decision. October’s Non-farm payroll report will also carry significant influence over markets. Additionally, imports, exports and trade balance, and several Purchasing Managers Indexes will be released in a busy week for announcements

- Globally, the rounds of important announcements continue with the Eurozone’s Consumer Price Index, Producer Price Index, and Gross Domestic Product scheduled.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.