IAIC Market Update - October 24, 2022

Last Week in the Markets: October 17th – 21st, 2022

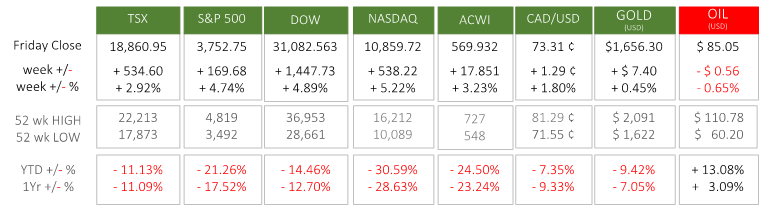

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- North American equity indices had a strong week Monday to Thursday, and Friday was almost as good as the preceding four days when the indices jumped 1.5 to 2.5% on the final trading day of the week.

- Although it was an exceptionally strong week for equities, not all the news was positive. Chrystia Freeland, the federal Finance Minister, warned that a domestic economic slowdown is expected in the coming months. She indicated that this is the natural consequence of the Bank of Canada’s interest rate increases enacted to attack inflation. (Source)

- Canadian consumer inflation was above expectations on a monthly and annual basis. Although inflation moderated slightly from 7.0% in August to 6.9% in September on a year-over-year basis prices increased in September by 0.4% on a seasonally adjusted basis. The decline in gasoline prices was largely responsible for moderating the monthly increase as price increases in other areas, like groceries, continued their trajectory. (Source)

- There is growing sentiment that the Federal Reserve and Bank of Canada are getting closer to the end of their rate-hiking cycle. The need to “front load” rate-increases, raising rates early to cause an effect sooner, is believed to reduce the overall negative effects by ending high inflation sooner. Another result as inflation begins to come under control is that future interest rate increases are reduced. Central banks continue to walk the fine line of slowing the economy to reduce inflation, while not dropping into a recession. (Source)

What’s ahead for this week?

- In Canada, the scheduled economic releases are few, but important for the coming week. Manufacturing sales will be released just prior to the Bank of Canada’s monetary policy report and interest rate announcement, which precedes Gross Domestic Product and the Budget Balance for August.

- In the U.S., the house price index, mortgage market index, new home sales, goods trade balance, crude oil, heating oil and gasoline reserves, wholesale inventories, durable goods orders, consumer spending, Q3 GDP will be released along with the influential Core PCE price index.

- Globally, the scheduled announcements include China’s house price index, Q3 GDP, industrial production, retail sales, trade balance, Japan’s CPI, Bank of Japan interest rate decision, employment report, and the European Central Bank’s interest rate decision on Thursday.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.