IAIC Market Update - October 11, 2022

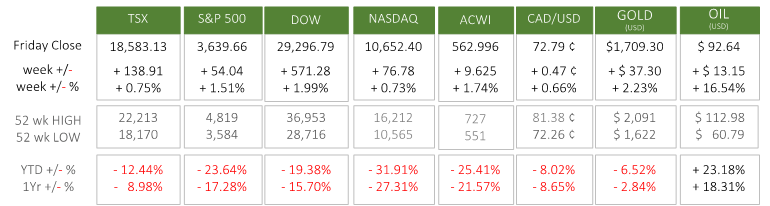

Last Week in the Markets: October 3rd – 7th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The announcement on Friday of strong U.S. jobs numbers continued to fuel expectations that the Federal Reserve Bank will maintain their current course of rate increases to slow inflation.

- Total nonfarm payroll employment increased by 263,000 in September and the unemployment rate edged down to 3.5%. (Source)

- The number of new jobs announced was below the number created in the last few months, but still relatively strong, especially as the headwind of increasing interest rates builds strength.

- Wages are 5% higher than one year ago as gains continued in hospitality, healthcare, services, and manufacturing. (Source)

- Also, on Friday Canadian employment figures for the same period were released. Although employment was only up slightly with 21,000 new jobs the unemployment rate fell 0.2% to 5.2% as labour force participation fell (fewer people searched for work). Employment in the public sector, education, and healthcare services rose as manufacturing, transportation and recreation fell. Average hourly wages have risen 5.2% over the past year, which helps offset some inflation impacts. (Source1, Source2)

- The effects on markets had been building all week. Monday and Tuesday brought gains for North American equity indices, which were reversed as the jobs announcements approached. The prevailing opinion is that another large interest rate increase will be enacted by the Federal Reserve at their next meeting scheduled for the beginning of November. Higher interest rates and the resultant slowing economy are expected to lower corporate profits and have reduced stock prices across the indexes. (Source)

What’s ahead for this week?

- In Canada, after Thanksgiving on Monday a light week for economic announcements follows with manufacturing sales, motor vehicle and wholesales sales to be released.

- In the U.S., inflation will be in the news again with Consumer Price Index (CPI) and the Producer Price Index scheduled. The meeting minutes from the most recent Federal Open Market Committee meeting at the Federal Reserve will be released. The Import and Export Price Indexes will also be announced.

- Globally, the release of German and French CPI will continue the inflation parade of announcements. China will announce its imports, exports, and trade balance along with its consumer and producer inflation for September.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.