IAIC Market Update - November 8, 2021

Last Week in the Markets: November 1st - 5th, 2021

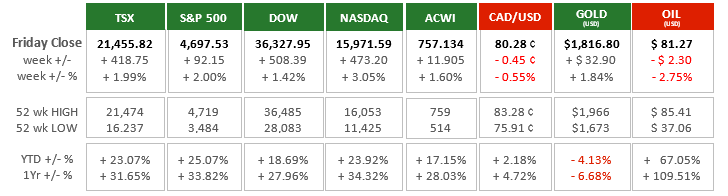

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Following last week’s action by the Bank of Canada to eliminate its bond-buying program, the U.S. Federal Reserve (Fed) took a similar and more protracted approach. Both are reducing support for economic recovery to curtail inflation. Additionally, the temporary nature of price increases is being questioned. As a result, the Federal Reserve will reduce bond purchases by $15 Billion/month from the current $120 Billion/month total. If this reduction schedule holds, the bond-buying program (known as quantitative easing) will end in June of next year. The purchases of bonds help to stimulate economic activity by reducing long term interest rates. Fed Chair, Jerome Powell, indicated that short term interest rates would remain unchanged. A video of Powell’s announcement is available here.

- Canada added 31,000 jobs in October and the unemployment rate fell to 6.7%. September reported nearly five times as many jobs, which may indicate a softening of employment results.

- In September the U.S. economy underperformed in job creation and has since rebounded by adding 531,000 jobs in October, lowering the unemployment rate to 4.6%. The American wage rate has increased by 4.9% compared to the same period last year. Rising U.S. wages along with more persistent housing costs and food prices may have contributed to the Fed’s decision to slow its bond purchasing program to temper inflation.

What’s ahead for this week?

- In Canada, the economic announcements scheduled are not significant for most retail investors. Bond markets in Canada (and the U.S.) will be closed on Thursday for Remembrance Day. It will be an important week for earnings results as several Real Estate Investment Trusts (REITs) will be announcing their performance figures.

- In the U.S., the most recent inflation numbers will be released through the announcement of the Consumer Price Index. Wholesale inventories will be announced and the Chair of the Federal Reserve, Jerome Powell, will be speaking at several conferences and will likely comment on the Fed’s decision from last week.

- Globally, China will announce its inflation numbers for both consumers and companies as their CPI and Producer Price Index (PPI) are released. Germany will also release its CPI.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.