IAIC Market Update - November 21, 2022

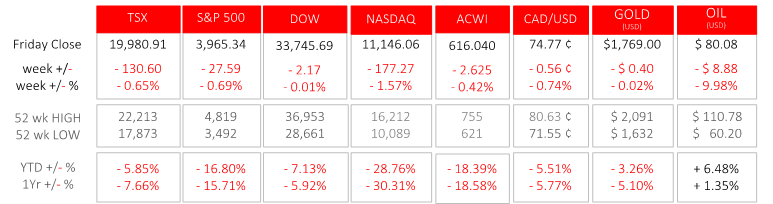

Last Week in the Markets: November 14th – 18th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Interest rates, inflation and recession concerns continued to influence markets last week. The mixed news, and its implications had equities falling for the week, albeit only slightly.

- For the second consecutive week, a key U.S. inflation indicator has fallen. The Producer Price Index (PPI), which measures inflation at the wholesale level, had its year-over-year rate at 8.0% for October. The annualized rate of producer inflation has dropped from over 10% earlier this year and a peak in March 2022 of 11.7%. On November 10th the latest Consumer Price Index (CPI), also for October, was reported. The annual inflation rate dropped to 7.7% from September’s 8.5%. (Source1, Source2)

- Domestically, Canadian consumer inflation for October equalled September’s annual rate at 6.9%. Gasoline and housing cost increases were offset by slowing increases for groceries (fruit, vegetables, and meat). Gasoline rose 9.2% in October after falling 7.4% in September. Overall, monthly price increases in October were 0.7%. Although Canada’s CPI did not fall, it also did not increase. (Source)

- The Organization for Economic Development and Cooperation (OECD) will soon release its inflation and growth analysis. Since their last projections in September the outlook has worsened. Inflation rose, notwithstanding some recent, minor successes, European economies have contracted, a resurgence of Covid with strong restrictions in China, and growing predictions of U.S. economic contraction next year. The predictions of inflation-fighting rate increases, their effectiveness and effect on GDP will guide markets into 2023 and beyond. (Source1,

Source2)

What’s ahead for this week?

- In Canada, retail, wholesale, and manufacturing sales for September will be reported on Tuesday along with the new housing price index. The Federal budget balance will be released on Friday.

- In the U.S., the mortgage market index, building permits, housing starts, and new home sales scheduled for release. Markets will close on Thursday and early on Friday for Thanksgiving.

- Globally, Germany, the leading European economy, will announce its Gross Domestic Product, the European Central Bank will conduct a non-monetary policy meeting, and the Eurozone’s consumer confidence will be released. Japan, the third largest economy, will report its consumer inflation.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.