IAIC Market Update - May 23, 2023

Last Week in the Markets: May 15th – 19th, 2023

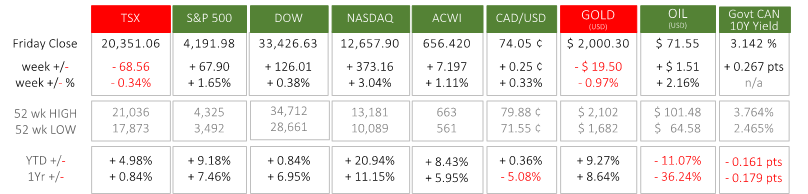

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a strong session for investors in U.S. equities, and the TSX was the only index that lost value. For the fourth consecutive week the NASDAQ bested the other major equity indexes. The gain of more than 3% in one week for the NASDAQ was nearly double the performance of the S&P 500, and well beyond the respectable, yet small, increase of the Dow.

- On Tuesday the latest consumer inflation data was released by StatsCan. In April the Consumer Price Index (CPI) rose 4.4% on a year-over-year basis, just slightly above the same figure for March, which was 4.3%. On a monthly basis prices increased by 0.7% in April, above March’s one-month inflation of 0.5%. Gasoline, groceries, rent, and mortgage interest were the largest contributors.

- The debt ceiling negotiations continue in the U.S. without resolution. President Biden has warned, “I can’t guarantee that they (Republicans) will not force a default by doing something outrageous”. Republicans would like significant reductions in government expenditures in exchange for an increase in the borrowing limit. Growing sentiment is that neither side will be able to escape blame should a default occur. The deadline to avoid a cash shortfall is approaching quickly, and President Biden and House Leader McCarthy had an in-person meeting scheduled for 5:30 pm on Monday. Honouring its debts by avoiding a default is necessary for the American, North American, and global economies.

Source: StatsCan CPI Release, Debt Ceiling Discussion, U.S. Debt Ceiling Standoff

What’s ahead for this week?

- In Canada, after Monday’s celebration of Victoria Day, when markets were closed, another light week for economic announcements will occur with wholesale and manufacturing sales, the federal government’s budget balance and the raw materials price index scheduled for release.

- In the U.S., building permits, pending home sales, new home sales, durable goods orders, Gross Domestic Product, and April’s Personal Consumption Expenditures (PCE) will be reported before Memorial Day is observed on May 29th. Also, the meeting minutes from the Federal Reserve’s latest interest rate announcement on May 3rd will be published.

- Globally, Eurozone consumer confidence, manufacturing and services Purchasing Managers Indexes, and a European Central Bank (ECB) meeting are scheduled. The Bank of Japan will release its inflation indicator and the Bank of China will announce its prime rate.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.