IAIC Market Update - March 29, 2021

Last Week in the Markets: March 22nd - 26th, 2021

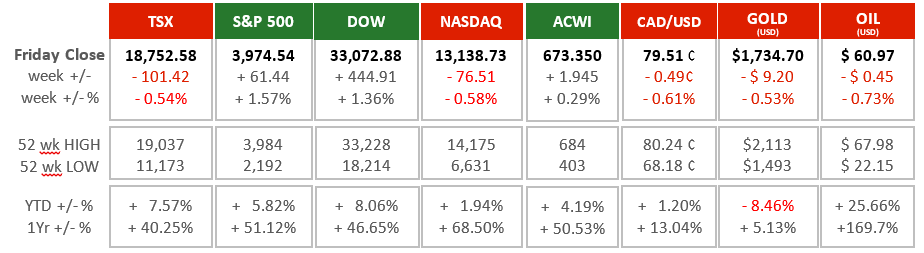

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a mixed week for North American equities as the TSX and NASDAQ lost ground while the S&P 500 and the Dow moved ahead.

- The primary driver of equity values continues to be the progress against the pandemic, both domestically and globally. Restrictions in Europe are being reimposed as case rates have begun to climb, which is a trend that is also reappearing in Canada and the U.S.

- The major equities indices have logged strong gains for the first 12 weeks of 2021. The NASDAQ lags the field at 2% for the year while the Dow leads with slightly more than 8% gains.

- Stimulus cheques began to arrive for American families and are expected to increase consumer spending in the short term. For longer-term economic stimulus, a proposed infrastructure bill has been introduced by the Biden administration. Both measures are designed to spur economic recovery.

- In Canada the Federal and Provincial government fiscal measures and Bank of Canada monetary policy moves have been generally successful. Fortunately for families and the most vulnerable, foreclosures and evictions have not risen as quickly as employment and business closures, but it has been very difficult for many. Like many businesses, governments and our central bank were forced to conduct operations virtually and imagine, design, and implement solutions in record time. A recap of some of the activity can be found here, it serves as a reminder of the challenges and solutions, as well as the timing and sequencing of them.

What’s ahead for this week?

- In Canada, the most significant economic release will be January’s Gross Domestic Product numbers which measures Canada’s overall output. The pace of its growth will indicate how well we are recovering during the pandemic. Also, the TSX will be closed on Friday.

- In the U.S., markets will be closed on Friday and economic releases will be lighter than usual during the short week. February’s construction spending, along with March’s Purchasing Manager’s Index (PMI) from both ISM and Markit are on the calendar.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.