IAIC Market Update - March 1, 2021

Last Week in the Markets: February 22nd - 26th, 2021

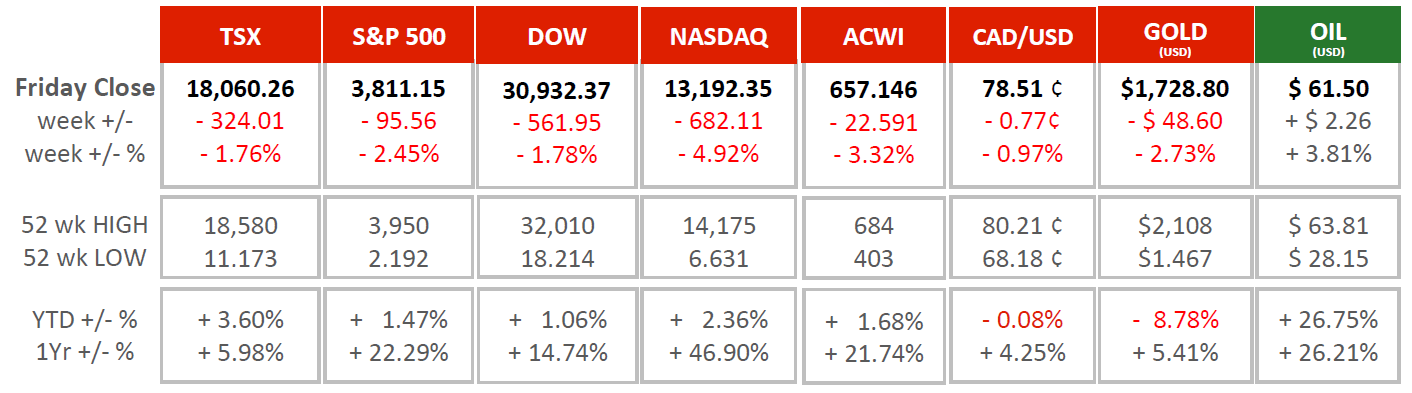

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was a trying week for North American equity investors.

- The major indices fell by 2% and the NASDAQ doubled that decline.

- The Canadian dollar lost another percentage point to its American counterpart.

- The lone gainer on our grid was oil, but it did not feel like positive progress at the gas pump, at least for Canadian consumers.

- The results by the large Canadian banks provided support for the TSX and its most heavily weighted sector, Financials.

- The Bank of Montreal and Scotiabank led off with profits higher than pre-pandemic levels for the most recent quarter.

- CIBC, RBC and TD also delivered impressive results.

- Lower loan-loss provisions, lower credit default rates, and increased revenues were the reasons the banks were able to exceed analyst earnings expectations. These institutions were able to best their own expectations and are admittedly further ahead on recovery than they expected. Collectively, they earned $13.9 Billion in the quarter ending on January 31st. (Source)

What’s ahead for this week?

- In Canada, December and the 2020 Q4 Gross Domestic Product numbers will be released and will provide the latest data on our economic recovery. January’s building permits and trade balance are also scheduled.

- In the U.S., the Purchasing Managers Index from ISM for both products and services will be released. These reports summarize the forward-looking confidence of corporate buyers. February’s employment numbers will demonstrate if the U.S. recovery has resulted in improvements in jobs, job creation and joblessness.

The latest details from the Canadian Federal Government on stimulus and economic assistance are available here.

The latest details of the current Canada’s Covid-19 Economic Response Plan are available

here.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.