IAIC Market Update - June 27, 2022

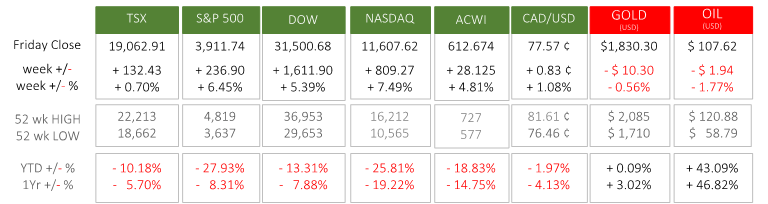

Last Week in the Markets: June 20th – 24th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Overall equity indices in North America reversed the losses of two weeks ago with a strong showing.

- The TSX regained less than 1%, while the U.S. indexes rebounded with increases of 5.4% to 7.5%. For Canadian investors who hold assets in U.S. funds, these powerful gains south of the border were trimmed by a 1% decline in the U.S. dollar. Nonetheless, a reversal and movement to the positive was a welcome respite for equity investors.

- The light economic news last week was overshadowed by U.S. Supreme Court decisions and Congress actions. House prices across the U.S. moved upward, which was not expected, and crude oil declined. It appears that recession fears have ebbed, and the previous negative view may have been too pessimistic. The sentiment was that bargains existed after the preceding weeks of losses (the S&P 500 had 10 weekly losses in the last 11 weeks), and share prices were bid upward as value was gathered.

- Consumer inflation in Canada rose in May to 7.7% year-over-year (YOY), an increase from the April YOY level of 6.8%. The price increases, as most Canadians would know, was driven by the price of gasoline, which rose 12% last month, and has risen by 48% over the past year. Groceries rose 9.7% in May, equaling the increase of April. On a monthly basis inflation rose 1.4% in May, more than double the monthly increase of 0.6% experienced during April. (Source)

- In eras of volatility, and when volatility is low, disciplined investing has been proven to be the best long-term strategy. The equity markets have been volatile, and negative, for 2022 and retirement portfolios deserve discipline. (Source)

What’s ahead for this week?

- In Canada, prior to the celebration of Canada on Friday, July 1st, the major economic release on a relatively quiet week with April’s Gross Domestic Product update.

- In the U.S., May’s durable goods orders, pending home sales, house price index, goods trade balance, wholesale inventories, and personal spending will be released. June’s purchasing managers indexes from ISM and Markit are scheduled. First quarter consumer spending and GDP will also be announced.

- Globally, OPEC will conduct a meeting to agree short-term production levels. China will release its industrial profits for YTD and YOY. Japan will announce its latest consumer inflation level. Eurozone inflation and GDP will be announced along with Germany’s retail sales and employment figures.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.