IAIC Market Update - June 19, 2023

Last Week in the Markets: June 12th – 16th, 2023

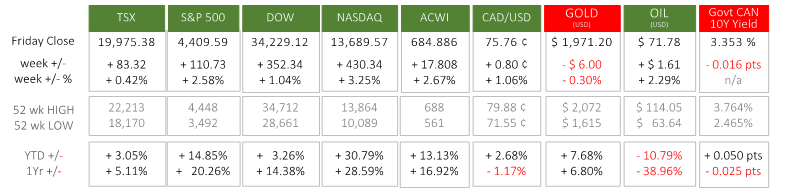

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Markets moved ahead broadly last week, as North American and global equities positively interpreted two significant and related announcements on inflation and interest rates.

- On Tuesday, the U.S. Bureau of Labor Statistics reported consumer inflation for May. The Consumer Price Index (CPI) rose 0.1% during the month after increasing by 0.4% in April. The year-over-year inflation rate dropped significantly to 4.0% after sitting at 4.9% at the end of April. The annual rate of inflation fell for the 11th consecutive month.

- On Wednesday the Federal Reserve released its latest monetary policy. For the first time in the last 11 interest rate announcements, rates were unchanged. Since inflation remains well above the 2% target, nearly all of the Fed Governors believe that additional rate hikes will be necessary, suggesting that the pause on June 14th is only temporary. The Bank of Canada had increased rates at 8 consecutive meetings, then paused in March and April, and then raised rates by ¼% on June 7th. Domestic and international inflation and monetary policy guided the Canadian central bank’s return to rate increases. Inflation and interest rates elsewhere are less influential for the Federal Reserve.

- Additionally, on Friday the Eurozone released year-over-year inflation information for May with the Consumer Price Index at 6.1%, down from 7% in April.

- This news positively affected American equities most with NASDAQ and S&P500 gaining 3¼% and 2½%, respectively. The Dow topped a 1% gain for the week, while the TSX rose less than ½%.

Source: Consumer Price Index Summary, BoC Release, NYTimes & Fed, Euro Area Inflation Rate

What’s ahead for this week?

- In Canada, producer and raw materials prices and inflation, new housing price index, retail sales, federal government budget balance, and the Bank of Canada’s deliberations from its interest rate decision of June 7th will be released.

- In the U.S., after a busy week last week with an inflation and interest rate announcement, indicators will focus on housing with building permits, housing starts, existing home sales scheduled for release.

- Globally, consumer and producer inflation data will be released for the U.K. just prior to a Bank of England interest rate announcement. The European Central Bank will conduct a General Council Meeting. Japan will report its industrial production and capacity utilization and release monetary policy meeting minutes from the Bank of Japan.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.