IAIC Market Update - June 12, 2023

Last Week in the Markets: June 5th – 9th, 2023

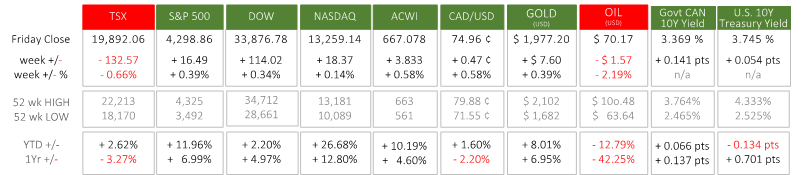

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Canada’s TSX was the only major North American equity indexes that lost value last week. It fell about 1% behind the performance of its U.S. peers, who each made modest gains below ½%.

- On Wednesday morning the Bank of Canada raised its policy interest rate by 25 basis points (¼ percent). The target for the overnight rate rose to 4¾%, the Bank rate to 5% and the deposit rate to 4¾%. In the press release The Bank stated:

“Globally, consumer price inflation is coming down, largely reflecting lower energy prices compared to a year ago, but underlying inflation remains stubbornly high. While economic growth around the world is softening in the face of higher interest rates, major central banks are signalling that interest rates may have to rise further to restore price stability.”

- Next week the Federal Reserve, the U.S. central bank, has a monetary policy update scheduled for Wednesday, June 14th. The action this week from Canada is anticipating an increase from the Fed, and our increase is intended to address the recent uptick in our inflation rate and protect the Canadian dollar’s value. Additionally, the European Central Bank will make its next interest rate decision on June 15th.

Source: Bank of Canada Press Release, CBC: Bank of Canada Rate Decision

What’s ahead for this week?

- In Canada, a light week for economic releases with housing starts manufacturing and wholesale sales, and investment inflows scheduled.

- In the U.S., a much heavier week for announcements is planned with retail sales, import/export inflation, consumer inflation, producer inflation, industrial production, capacity utilization, and business inventories on the calendar. The upcoming interest rate announcement from the Federal Reserve will be the most influential release of the week and, likely, the month.

- Globally, inflation numbers will be released in the Eurozone, specifically Italian and French consumer and import/export inflation, and overall EU industrial production.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.