IAIC Market Update - July 13, 2021

Last Week in the Markets: July 5th - July 9th, 2021

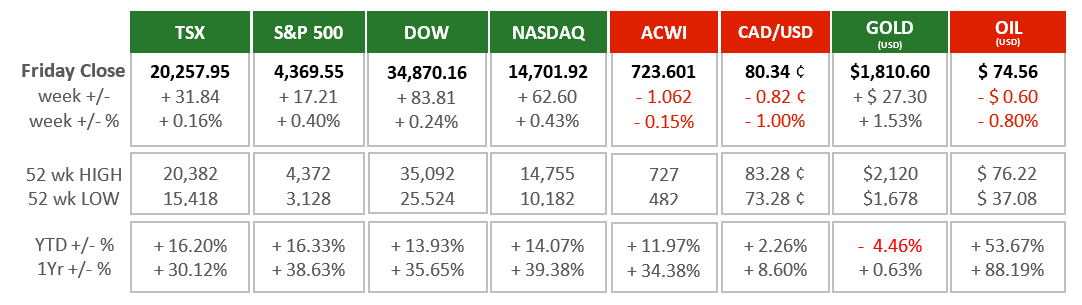

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- It was another strong week for North American equities. Even though U.S. markets were closed for the Independence Day festivities on Monday, there were modest gains on the Dow and NASDADAQ, while the S&P 500 achieved another new, all-time high. Canada’s TSX repeated the previous week’s performance by treading water again. Last week’s gain of 0.16% easily reversed the preceding loss of 0.02% from the week ending July 2nd.

- Negative news has been neutralized by Canadian jobs growth.

- Jobs rebounded well in June as expansion and recovery continued as re-opening moved forward. 230,000 new jobs were added last month after losing 63,000 jobs in May.

- The unemployment rate has been falling slowly, but unfortunately it is as much a reflection of lowering of job seekers as job finders. The second half of the year it is traditionally a time of a strong job market (summer employment and holiday season hiring, for example). As more people re-enter the job market the seasonal hiring increases should hold the unemployment rate steady or continue its slow decline.

- Despite the uncertainty associated with pandemic’s lingering effects a strong second half to the year for jobs growth and productivity.

- The recovery of Gross Domestic Product (GDP) in North America has been impressive. Once restrictions began to lift, pent-up demand and access to goods and services has moved economic indicators ahead briskly. The drivers have been the spending of savings of individuals caused by deferred purchases and the spending of government payments to individuals. The expectation is that consumer spending, which comprises about two-thirds of GDP, will continue to power economic expansion as the recovery continues.

What’s ahead for this week?

- In Canada, industrial inflation, manufacturing sales, housing starts, and existing home sales numbers will be released. On Wednesday the Bank of Canada will release its latest Monetary Policy Report.

- In the U.S., June consumer and producer inflation data for June will be released along with retail sales. Consumer inflation is forecast to rise 0.4% from May which would quell worries for interest rate rises to stifle inflation.

- Globally, China will release its trade surplus figures, retail sales, industrial production and second quarter Gross Domestic Product, Germany, UK, France and the collective Eurozone will all announce their inflation data.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.